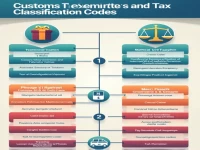

Comprehensive Analysis of Customs Duty Exemption Categories and Codes

This article provides a comprehensive analysis of the classification of customs duty exemptions and their corresponding codes. The exemptions are categorized into statutory taxation, tax reductions and exemptions, and specific policy areas. Each category includes clear definitions and applicable scopes, covering areas such as gratuitous assistance, technological transformation, and infrastructure development. This information serves as a foundation for import and export enterprises to understand and utilize tax policies, helping them gain an advantage in international trade.