Luxury Watch Trade Decoding HS Codes and Global Markets

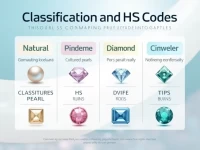

The article delves into the HS coding system for luxury watches, providing insights into the classification of precious metal electronic and mechanical watches, as well as the export tax rebate policies. It highlights the significance of understanding this information for both consumers and businesses.