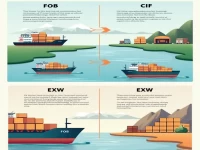

Deep Dive Into International Trade Terms Understanding The Importance Of Incoterms In Global Transactions

Incoterms® are standard terms used in international trade that define the obligations, costs, and risks associated with the delivery of goods for both sellers and buyers. This article provides an in-depth exploration of the current Incoterms® 2020 version, explaining its applicable terms and significance. Understanding these terms helps businesses conduct transactions efficiently and accurately in the international market.