US Implements AMS and ISF Measures to Secure Global Trade

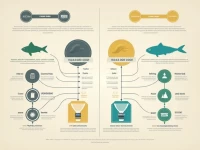

This article provides an in-depth analysis of the differences between AMS (Automated Manifest System) and ISF (Importer Security Filing) and their respective filing parties. AMS is the responsibility of the carrier for verifying manifest information, while ISF is the importer's responsibility for declaring cargo security. Together, they safeguard global trade security, ensuring the efficient and secure arrival of goods. This collaborative approach is crucial for maintaining a robust and compliant international trade environment.