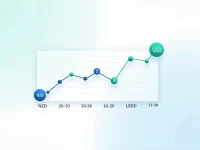

USDINR Surges to Record High Trading Strategies Emerge

USDINR has broken its all-time high. Trading strategies should focus on Fibonacci extension levels. A fall below 90.5735 may favor the bears, while bulls will maintain control if the price holds above, targeting 92.1815. Close attention to risk levels and adaptability are crucial for profitable trading. The breakout suggests continued upward momentum, but traders should remain vigilant for potential pullbacks and reversals based on Fibonacci levels and overall market conditions.