US Warehouse Shortage Hits Record Low CBRE Reports

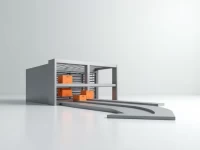

A CBRE report indicates that the US industrial real estate vacancy rate continues to decline to a historic low, exacerbating the supply-demand imbalance. E-commerce growth and economic expansion are key drivers, with future supply expected to catch up with demand. Businesses need to pay attention to market segmentation differences, technological innovation, and policy impacts. By seizing opportunities and addressing challenges, companies can achieve long-term growth in the industrial real estate sector.