The latest "US Industrial Availability Index" report from CBRE reveals unprecedented challenges in the industrial real estate market, with shrinking available space and intensifying supply-demand imbalances making it increasingly difficult for businesses to secure warehouses and distribution centers.

Availability Hits Record Low for 34th Consecutive Quarter

CBRE's key finding shows US industrial availability dropped to 7.0% in Q4 2018 - an 8 basis point decline from Q3 and the lowest level since 2000. This marks the 34th consecutive quarterly decline, the longest continuous downward trend since CBRE began tracking this data in 1988.

Regional Variations Persist as Demand Outpaces Supply

Among 55 major US markets tracked, 38 saw availability declines in Q4 while 20 showed increases. Demand outpaced new supply by nearly 6 million square feet, with net absorption reaching 63 million square feet versus 57 million square feet in completions. While the quarterly gap narrowed from Q3's 9.3 million square feet disparity, annual demand still exceeded supply by 29 million square feet in 2018.

E-Commerce and Economic Expansion Drive Long-Term Growth

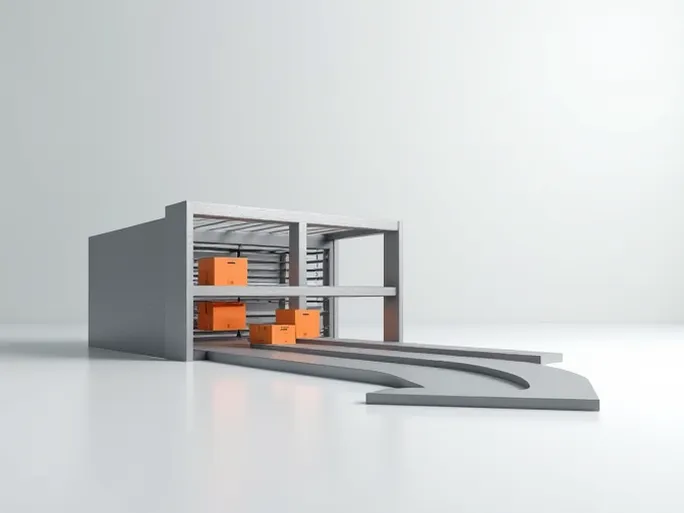

The report identifies e-commerce growth as the primary market driver, with retailers requiring more sophisticated distribution centers to handle online orders. Strong economic conditions have simultaneously boosted manufacturing and logistics expansion.

Future Outlook: Supply May Catch Up, But Fundamentals Stay Strong

CBRE anticipates new construction will eventually meet demand, potentially stabilizing availability rates. However, they project continued long-term growth supported by e-commerce expansion, economic resilience, and demographic shifts - even amid rising interest rates and trade policy uncertainties.

Strategic Considerations for Market Participants

The report highlights significant regional variations, with logistics hubs near transportation infrastructure experiencing particularly strong demand. CBRE advises:

For investors/developers: Conduct granular market analysis, prioritize technology integration, secure land in high-demand areas, and collaborate on infrastructure improvements.

For tenants: Plan ahead for space needs, explore flexible solutions like shared warehouses, implement efficiency technologies, and cultivate strong landlord relationships.

Policy factors including trade regulations and infrastructure investments may significantly influence future market conditions, requiring close monitoring by industry participants.