July 2024 Comprehensive Analysis and Trend Outlook for China's Export Container Shipping Market

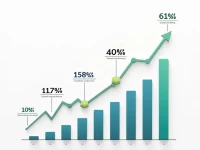

In July 2024, China's export container transportation market showed stable improvement with an overall increase in freight rates, as the freight index for major routes generally rose. Despite ongoing challenges affecting the European and North American markets, port throughput has been trending upwards, and the ship leasing market remains active, demonstrating the resilience and potential of the container shipping market.