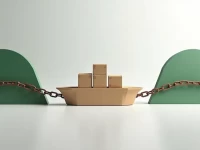

East Coast Port Strike Threatens US Retail Imports

US import volume is projected to increase significantly in August due to retailers front-loading inventory amid potential strikes at East and Gulf Coast ports. Reports indicate retailers are also diverting some cargo to West Coast ports to mitigate strike risks. The Red Sea crisis further exacerbates supply chain challenges. Retailers need to closely monitor market dynamics and adapt their strategies to navigate these complexities. This proactive approach aims to minimize disruptions and ensure a steady flow of goods despite the ongoing uncertainties in the global supply chain.