NZ Dollar Fluctuations Impact Purchasing Power

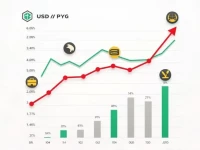

The current exchange rate for the New Zealand dollar (NZD) is 10,000 NZD to 5,959.64 USD, showing slight fluctuations that have attracted market attention. Investors need to monitor changes in the New Zealand economy and international markets to make informed decisions.