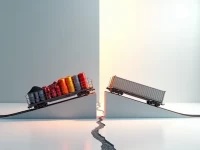

US Rail Freight Sees Mixed Results Carloads Rise Intermodal Falls

According to the Association of American Railroads, U.S. rail carloads increased by 1.1% for the week ending March 19, primarily driven by coal and chemical shipments, while intermodal traffic decreased by 5.7%. Year-to-date, carloads are up 3%, but intermodal volume is down 7.1%. Overall, North American rail freight volume is declining. This data provides insights into the current state of the freight transportation sector and serves as an economic indicator.