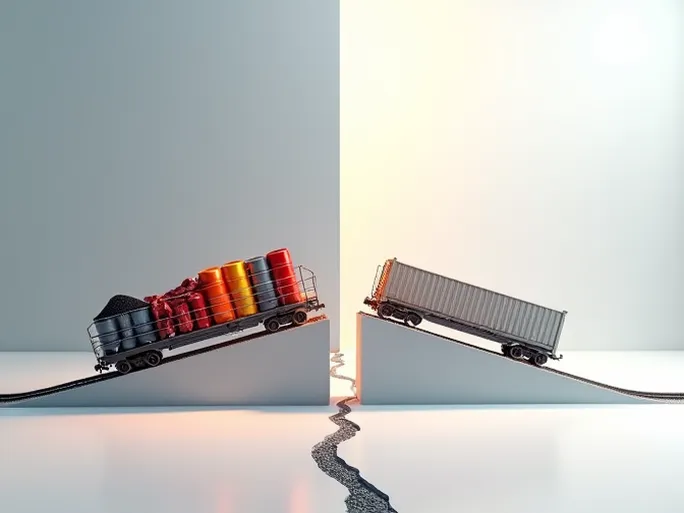

As global supply chains continue to face disruptions, rail freight has emerged as a critical indicator of economic health. Recent data from the Association of American Railroads (AAR) reveals a mixed picture for the week ending March 19, with carload traffic showing modest growth while intermodal volumes declined sharply. This divergence highlights the uneven nature of the US economic recovery.

Carload Traffic Rises Modestly, Driven by Coal and Chemicals

For the week ending March 19, US rail carloads reached 232,770 units, representing a 1.1% increase compared to the same period last year. This marginal growth was supported by strong performance in certain commodity categories. Among the 10 major commodity groups tracked by AAR, five showed year-over-year increases.

Coal shipments led the growth, adding 4,182 carloads for a total of 63,929 units. Chemical transportation also performed well, increasing by 2,656 carloads to reach 34,178 units. Nonmetallic minerals saw gains as well, rising by 1,984 carloads to 31,151 units.

However, not all sectors shared in this growth. Grain transportation declined significantly, dropping by 4,014 carloads to 23,317 units. Petroleum and petroleum products also decreased, falling by 2,457 carloads to 9,181 units. Automotive shipments declined by 958 carloads to 13,953 units, reflecting ongoing supply chain challenges in the sector.

Intermodal Volumes Decline Amid Supply Chain Bottlenecks

In contrast to the modest growth in carload traffic, intermodal volumes fell sharply. For the week ending March 19, US rail intermodal containers and trailers totaled 266,592 units, representing a 5.7% decrease year-over-year. This decline suggests persistent challenges in the intermodal market, which is typically viewed as a more efficient and environmentally friendly transportation option.

The intermodal sector's struggles may be attributed to multiple factors, including port congestion, trucking capacity shortages, and shifting consumer demand patterns.

Year-to-Date Trends Show Similar Pattern

Examining the broader timeframe from the beginning of 2022 through March 19 reveals a continuation of these trends. AAR data shows US rail carloads totaling 2,521,622 units year-to-date, representing a 3% increase compared to the same period in 2021. Meanwhile, intermodal volumes stood at 2,828,405 units, down 7.1% year-over-year.

North American Rail Freight Shows Overall Decline

Looking at the broader North American market, which includes the US, Canada, and Mexico, total rail freight volumes for the week ending March 19 reached 677,006 carloads and intermodal units, representing a 3.5% decline year-over-year. Year-to-date figures for North America show total rail freight volumes of 7,249,341 carloads and intermodal units, down 4% compared to 2021.

Multiple Factors Influence Rail Freight Performance

The divergent performance in rail freight reflects the complex interplay of multiple economic factors. Rising energy prices have boosted demand for coal transportation, while semiconductor shortages continue to constrain automotive shipments. Supply chain bottlenecks, including port congestion and truck driver shortages, have particularly impacted intermodal operations.

Additionally, changing consumer behavior, particularly the growth of e-commerce, has created new demands for rapid, flexible logistics solutions that challenge traditional rail freight models.

Future Outlook Requires Adaptation

To navigate this challenging environment, the rail industry must embrace transformation. Key priorities include infrastructure investment to enhance capacity and efficiency, stronger collaboration with other transportation modes to improve intermodal operations, and adoption of new technologies such as IoT, big data analytics, and artificial intelligence to optimize performance.

| Metric | Week Ending March 19 | Year-over-Year Change | Year-to-Date (Through March 19) | Year-over-Year Change |

|---|---|---|---|---|

| US Rail Carloads | 232,770 | +1.1% | 2,521,622 | +3% |

| US Rail Intermodal | 266,592 | -5.7% | 2,828,405 | -7.1% |

| North American Carloads | 328,840 | -0.7% | - | - |

| North American Intermodal | 348,166 | -6% | - | - |

| North American Total (Carloads + Intermodal) | 677,006 | -3.5% | 7,249,341 | -4% |