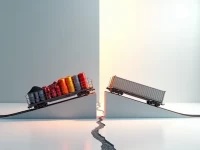

US Rail Freight Decline Signals Economic Concerns

For the week ending August 12, U.S. rail freight and intermodal volumes both declined. Carloads of motor vehicles & parts and petroleum products increased, while grain, chemicals, and forest products decreased. Year-to-date freight volume saw a slight increase, but intermodal volume experienced a significant drop. Businesses need to assess the situation and adjust their operating strategies accordingly. The decline in intermodal volume is a notable trend impacting the overall freight landscape.