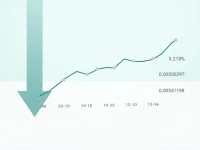

JPY to GBP Exchange Rate Trends Amid Market Shifts

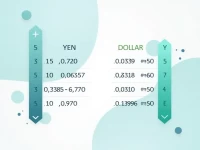

This article analyzes the latest exchange rate data for the yen against the pound, highlighting a 5.21% depreciation of the yen over the past year. It also provides information on the lowest and highest exchange rates, aiming to assist investors in understanding the fluctuations in currency value and their potential impacts.