Yen Nears Intervention Levels Amid Economic Pressures

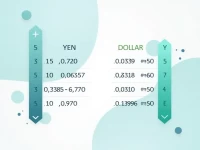

The yen has weakened against the US dollar to a one-year low, approaching the key psychological level of 160. Verbal intervention by the Japanese government has had limited effect, and the 'Takaichi Trade' continues to exert downward pressure. While depreciation may benefit exports, the risk of 'yen carry trades' needs to be monitored. Investors should remain cautious, pay close attention to policy developments, and implement robust risk management strategies. The continued weakness of the yen presents both opportunities and challenges in the current economic climate.