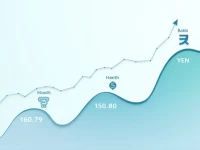

Yen Weakens Against USD Amid Market Volatility

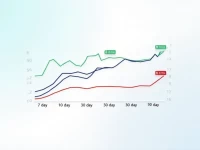

This article analyzes the latest exchange rate of 25 USD to JPY, providing relevant market data and trends. It emphasizes the significance of exchange rate fluctuations and introduces the bi-directional exchange rate between the yen and the dollar. The aim is to assist investors and consumers in making more informed foreign exchange decisions.