In the context of global economic fluctuations, the exchange rate between the Canadian dollar (CAD) and the euro (EUR) has drawn significant attention from market participants. This analysis examines recent currency movements and explores potential future trends.

Current CAD-EUR Exchange Rate Situation

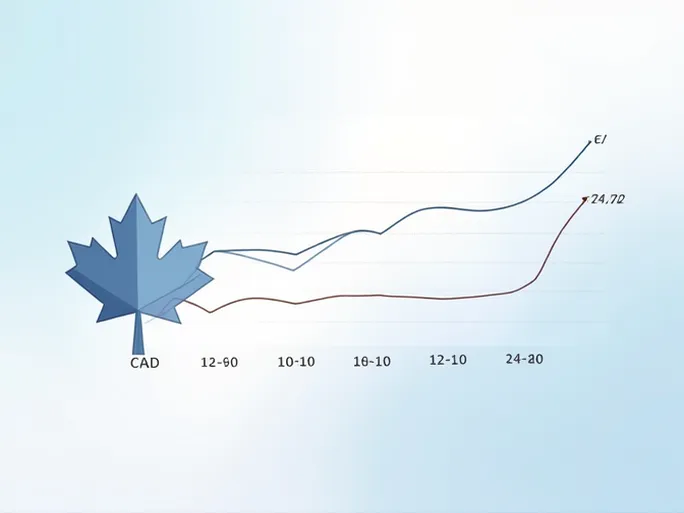

As of August 8, 2025, the Canadian dollar has stabilized at 1 CAD = 0.625301 EUR , according to the latest available data. This figure represents a 6.02% decline from its peak value over the past year.

A review of the annual exchange rate fluctuations reveals:

- Annual low: 0.620012

- Annual high: 0.686594

These fluctuations demonstrate how the Canadian dollar's strength remains susceptible to multiple factors, including global economic conditions, energy market prices, and international trade dynamics.

CAD Performance Against Other Major Currencies

The Canadian dollar has shown varied performance across different currency pairs, with notable weekly changes including:

- 1 CAD = 0.727966 USD ( 1.01% weekly gain )

- 1 CAD = 0.541854 GBP ( 1.04% weekly decline )

- 1 CAD = 107.420 JPY ( 1.04% weekly decline )

- 1 CAD = 1.11655 AUD ( 0.49% weekly decline )

- 1 CAD = 5.22911 CNY ( 0.60% weekly gain )

These movements reflect both domestic economic conditions in Canada and broader global market turbulence affecting the currency.

Key Factors Influencing the CAD-EUR Exchange Rate

Several critical elements continue to shape the relationship between the Canadian dollar and the euro:

1. Economic Indicators: Key data releases including GDP growth, inflation rates, and employment figures directly impact the Canadian dollar's valuation. The Bank of Canada's potential interest rate adjustments in response to these metrics can cause significant currency fluctuations.

2. Oil Price Volatility: As a major energy exporter, Canada's economic health and its currency remain closely tied to global oil prices. Historically, CAD strengthens with rising crude prices and weakens during downturns.

3. Global Economic Conditions: Geopolitical tensions, natural disasters, and international trade developments continue to create exchange rate volatility.

4. Central Bank Policies: Monetary policy decisions by the Bank of Canada, European Central Bank, and U.S. Federal Reserve create ripple effects across currency markets.

Market Outlook and Future Projections

Analysts anticipate ongoing fluctuations in the CAD-EUR exchange rate as markets respond to evolving economic conditions. Some observers suggest that potential economic recovery could benefit the Canadian dollar, particularly if energy prices enter an upward trajectory.

However, significant challenges remain. Persistent uncertainty in European markets, combined with tightening monetary policies across major economies, may continue to pressure the Canadian dollar's performance against the euro. Market participants are advised to monitor these developments closely while implementing appropriate risk management strategies.