In today's globalized financial environment, international money transfers have become increasingly common and convenient. However, for many individuals and businesses new to cross-border transactions, the terminology and procedures involved can appear complex and unfamiliar. This article provides a comprehensive breakdown of the international transfer process, with particular focus on selecting and using Fidelity Bank's SWIFT code, along with practical recommendations to ensure secure and efficient fund transfers.

1. Understanding SWIFT/BIC Codes and Their Significance

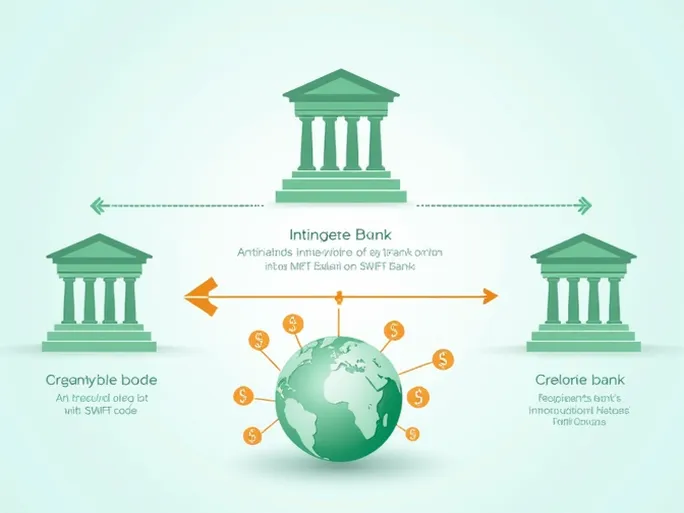

A SWIFT code (also known as BIC, or Bank Identifier Code) serves as a unique identifier assigned to financial institutions by the Society for Worldwide Interbank Financial Telecommunication. This standardized system enables precise identification of banks and their branches during international transactions. A typical SWIFT code consists of 8 to 11 characters structured as follows:

- First 4 characters: Bank code (usually an abbreviation of the bank's name)

- Next 2 characters: Country code (ISO 3166-1 standard)

- Following 2 characters: Location code

- Final 3 characters (optional): Branch-specific identifier

For Fidelity Bank, the SWIFT/BIC code is FIDTNGLAXXX . Utilizing this code ensures accurate routing of international transfers to the intended accounts within Fidelity Bank.

2. Obtaining Accurate Transfer Information

Accuracy in providing SWIFT/BIC codes and account details proves critical for successful international transfers. Common errors include incorrect codes, account numbers, or recipient names. To prevent such mistakes:

- Contact Fidelity Bank's customer service for current SWIFT code information

- Consult official bank documentation such as statements or wire transfer forms

- Verify details through recognized financial information sources

3. Application Scenarios for FIDTNGLAXXX

The FIDTNGLAXXX SWIFT code facilitates various international transfer scenarios:

- Personal remittances: Family support or personal gifts from abroad

- Commercial transactions: Business payments to Fidelity Bank account holders

- Project financing: Cross-border funding for development initiatives

Consistency between provided information and Fidelity Bank's records remains essential to prevent transfer delays or misrouting.

4. Selecting an Appropriate Transfer Service

Modern financial technology offers alternatives to traditional bank transfers, with specialized services often providing competitive advantages:

- Favorable exchange rates: Many platforms offer more advantageous currency conversion rates than conventional banks

- Reduced fees: Specialized services frequently charge lower transaction costs

- Expedited processing: Certain providers guarantee same-day transaction completion

5. Key Considerations for SWIFT Transfers

Before initiating international transfers, several factors warrant attention:

- Triple-verify all recipient details including SWIFT code and account information

- Account for processing time variations between institutions

- Understand applicable transfer amount limits

- Clarify all associated fees including intermediary bank charges

Promptly notify your financial institution if errors are detected, as international transfers often prove difficult to recall once initiated.

6. Guidelines for International Transfer Recipients

For individuals receiving international funds through Fidelity Bank:

- Provide complete banking details including branch address and account type

- Maintain clear communication with senders regarding transfer status

- Anticipate standard processing times of 1-5 business days

- Monitor currency exchange rate fluctuations that may affect final amounts

Proper understanding of SWIFT code functionality, coupled with careful attention to transfer details, significantly enhances the efficiency and reliability of international financial transactions. As global economic integration continues to advance, mastery of these fundamental banking concepts provides substantial value for both personal and commercial financial management.