When sending international wire transfers, selecting the correct SWIFT/BIC code is critical to ensuring the security and accuracy of your transaction. For transfers to Mexico, particularly to BANCO NACIONAL DE MÉXICO S.A., the SWIFT code BNMXMXMMINV plays a pivotal role in facilitating seamless cross-border payments.

Understanding SWIFT Codes

SWIFT codes, assigned by the Society for Worldwide Interbank Financial Telecommunication (SWIFT), are standardized identifiers that enable secure and efficient fund transfers between banks across borders. The code BNMXMXMMINV is uniquely assigned to BANCO NACIONAL DE MÉXICO S.A. and ensures that funds reach the intended destination without delays.

Decoding BNMXMXMMINV

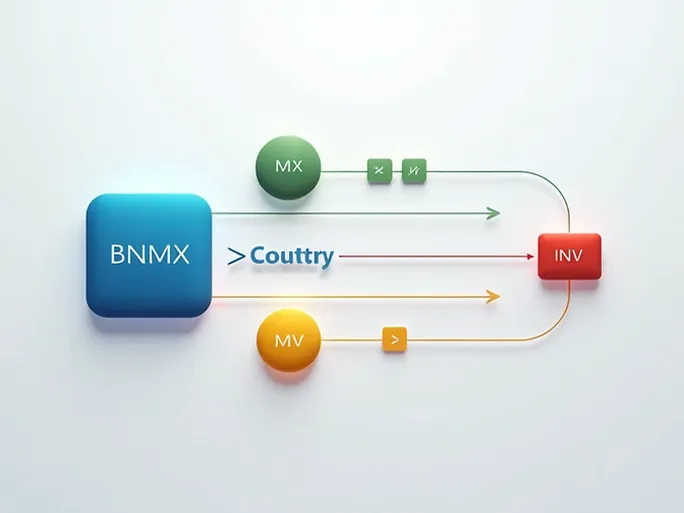

The SWIFT code BNMXMXMMINV is structured as follows:

- BNMX : The bank code for BANCO NACIONAL DE MÉXICO S.A.

- MX : The country code for Mexico.

- MM : The location code, indicating the bank’s headquarters.

- INV : The branch code. If the branch code is "XXX," it signifies the bank’s primary office.

Key Verification Steps

To avoid transfer errors or delays, follow these essential steps before initiating a transaction:

- Confirm the bank name : Ensure the recipient’s bank matches the name associated with the SWIFT code.

- Verify the branch : If using a branch-specific SWIFT code, confirm it aligns with the recipient’s branch.

- Check the country code : Validate that the SWIFT code’s country designation corresponds to the recipient’s location.

While these precautions may seem meticulous, they are indispensable for safeguarding the success of your international transfer. Accurate SWIFT code usage minimizes risks of processing issues and ensures timely delivery of funds.