Imagine this: at midnight, a customer places an order on their smartphone while a distant factory simultaneously purchases components online. Behind this seemingly simple operation lies the relentless rise of global e-commerce transactions and the fresh challenges and opportunities facing the logistics industry. For logistics managers, surging order volumes demand continuous process optimization and operational efficiency improvements to maintain competitive advantage.

The New Normal of E-Commerce

Online shopping has evolved from a convenience option to a lifestyle staple. Yet this boom conceals significant challenges. Rapid order growth strains labor and warehouse capacities, shorter delivery windows pressure transportation networks, and rising return rates complicate already busy fulfillment environments. Companies that previously planned around seasonal cycles now face year-round peaks, making uninterrupted demand increasingly difficult to manage. Market research indicates e-commerce will account for over 20% of global retail sales this year, with more than 50% of the global population aged 14+ becoming regular online shoppers within three years.

The 3PL Advantage

To handle escalating order volumes and capitalize on digital sales opportunities, shippers increasingly rely on third-party logistics providers (3PLs) for capacity expansion, order fulfillment management, and returns simplification.

Once primarily utilized by large enterprises or companies lacking internal logistics expertise, 3PL services have democratized. Providers now support shippers of all sizes, according to Evan Armstrong of Armstrong & Associates. "For mid-sized e-commerce fulfillment providers, the challenge lies in expanding wallet share by moving beyond basic order fulfillment into areas like transportation management," he explains.

Modern 3PLs offer consolidated shipping, negotiated carrier rates, and small-package-to-LTL conversions. This evolution benefits both parties: shippers access broader services at lower costs while 3PLs capture more value through expanded service offerings. Industry growth increasingly stems from existing clients deepening partnerships and assigning additional functions to their providers.

Tackling the Returns Challenge

E-commerce faces a returns epidemic. U.S. consumers returned nearly 17% of online purchases last year, representing $890 billion in merchandise. Categories like apparel and footwear see even higher return rates, with peak seasons exacerbating the problem. Unmanaged returns erode profits, tie up inventory, and jeopardize customer loyalty.

3PLs now offer specialized reverse logistics services including return label management, inspection processing, repackaging, and restocking. By consolidating returns, tracking reasons, and feeding data back to retailers, they help reduce overall return rates. For warehouses struggling with outbound fulfillment, outsourcing returns processing clears space, reduces labor pressure, and accelerates product reentry to sellable channels.

"Return management remains a massive challenge," notes Andy Lockhart of Vanderlande. "The goal is always to return merchandise to inventory as quickly as possible." Automation, quality checks, and demand-matching software help shorten this cycle—a returned black t-shirt might now be scanned, cleared, and reshipped the same day rather than sitting for weeks.

Technology as the Differentiator

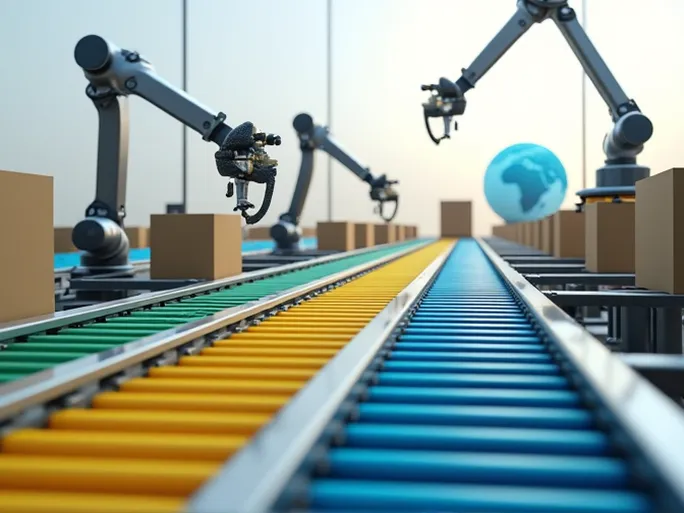

As e-commerce pushes order volumes higher, 3PLs increasingly deploy modern technologies to keep pace. Warehouse management systems (WMS) track inventory precisely, robots handle repetitive tasks, and cloud platforms provide real-time visibility. These tools help manage higher transaction volumes without sacrificing service or cost control.

Artificial intelligence now improves labor-intensive return quality assurance processes. Camera systems and machine learning tools identify defects, allowing human operators to focus on exceptions. For companies facing constant return flows, these technologies reduce manual work and recover more value from each returned item.

Mike Amanios of Datex Inc. observes that modern WMS solutions create "stickier" 3PL relationships by becoming integral to clients' operations. "When tightly integrated, the 3PL becomes an extension of the retailer's business," he says. This integration positions 3PLs as trusted partners where consistency and transparency drive repeat business.

The Automated Future

Automation trends accelerate in both B2C and B2B fulfillment. Collaborative robots, pick-to-robot systems, and automated guided vehicles (AGVs) proliferate, while AI applications emerge in dock scheduling, predictive analytics, and tighter WMS-TMS integration. Persistent labor shortages continue driving automation adoption, as companies struggle with rising wages and retention challenges.

With global e-commerce approaching $8 trillion, supply chains enter uncharted territory. Soaring order volumes, persistent returns, and labor constraints push investment in automation and integrated systems. 3PLs sit at the center of this transformation, providing the capabilities, technologies, and expertise shippers need to meet growing demands. For many, outsourcing logistics—both forward and reverse—has transitioned from luxury to necessity.

As contracts signed during pandemic disruptions come up for renewal, Armstrong advises shippers to benchmark 3PL performance and use tender processes to secure better terms. "This ensures your 3PL relationships stay aligned with today's market realities," he concludes.