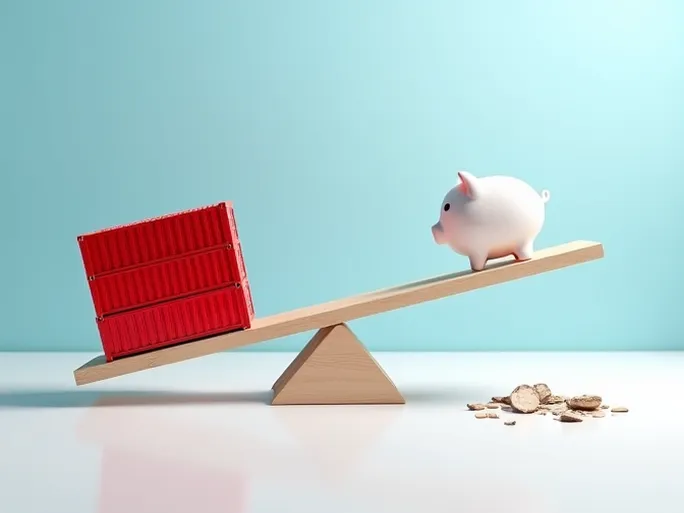

Cross-border e-commerce sellers are experiencing whiplash as recent U.S.-China tariff reductions have unexpectedly triggered a shipping price surge, compounding the challenges of an already volatile market.

Tariff Truce: A Brief Respite?

The month-long tariff war between the U.S. and China reached a temporary pause on May 14, with the U.S. reducing tariffs on Chinese imports from 145% to 30%. Notably, the T86 policy saw adjustments: tariffs on small parcels valued under $800 dropped from 120% to 54%, while maintaining a $100 per-item flat tax and canceling planned June increases. This apparent concession by the Trump administration suggests both nations may be entering a new phase of "fighting while negotiating."

Shipping Frenzy: U.S. Routes Face Capacity Crunch

The tariff reductions have sparked immediate action from U.S. businesses reliant on Chinese supply chains. Many American buyers promptly instructed Chinese factories to release held shipments, even offering to absorb higher freight costs to expedite deliveries. Reports indicate widespread stockpiling by U.S. purchasers.

A logistics company in Yiwu, Zhejiang province reported U.S. clients accelerating shipments, with projected volumes reaching 2,000 cubic meters within days. In Dongguan, one logistics firm has implemented round-the-clock shifts to handle the surge, booking over 200 containers in a single day.

At Shenzhen's Yantian Port, backlogged U.S.-bound goods are being rapidly processed through booking, picking, packaging, and loading operations. "With six daily U.S.-bound vessels, scheduling has become extremely tight," noted a terminal manager.

E-commerce sellers are racing to ship inventory ahead of Amazon's Prime Day, anticipating intense pressure on U.S.-bound logistics channels in coming weeks.

Carrier Price Hikes: Sellers Bear the Brunt

While sellers hoped tariff reductions would lower costs, the shipping surge has produced the opposite effect. Matson Navigation Company announced a $1,500 rate increase for 40-foot containers from Shanghai, Ningbo, and Xiamen to the U.S. effective May 22.

"We negotiated a 0.5% reduction when tariffs dropped 10%, but now freight quotes are rising instead," lamented one seller. The unexpected increases further squeeze already narrow profit margins.

With the shipping rush expected to continue, sellers must carefully plan both supply chains and logistics partnerships to mitigate losses.

The 90-Day Window: Critical Decisions Ahead

Despite rising costs, many sellers feel compelled to ship during this uncertain period. "His positions change faster than turning pages," remarked one seller about the Trump administration's unpredictable trade policies.

Reactions to the T86 adjustments remain mixed. Many sellers argue the 54% rate plus $100 per-item tax still creates prohibitive costs, particularly for small-packet direct shipping models. "Unless your margins are exceptionally high, direct shipping without small-packet exemptions isn't viable," commented a seller.

Extended customs clearance times—now 7-10 days compared to 3-5 days during duty-free periods—further complicate operations by delaying deliveries and potentially frustrating customers.

For FBA sellers, the tariff changes may offer silver linings by reducing competition from low-price direct-shipping competitors. However, with the 24% tariff reduction only guaranteed for 90 days, experts advise sellers to use this period for long-term strategic planning.

Diversification Strategies: Navigating Uncertain Waters

Platforms are increasingly adopting "semi-hosted + overseas warehouse" models to hedge against policy shifts. Temu now encourages U.S. warehouse pre-stocking to bypass tariffs, while major sellers like Anker Innovations and ZEALOT are establishing Southeast Asian production bases to diversify supply chains.

Smaller sellers are exploring multi-platform strategies, expanding to markets like South Korea's Coupang, Russia's Wildberries, and France's Fnac&Darty to reduce U.S. dependence. In this unpredictable trade environment, diversification may prove the most resilient approach.