Imagine you're a cross-border e-commerce seller. The U.S. dollars you've painstakingly earned sit idle in your account. As the USD/CNY exchange rate climbs steadily—from 6.3 at the start of the year to 7.24 now—you feel a rush of excitement. But hesitation soon follows: With the Federal Reserve likely raising rates again in November, could the dollar climb even higher? Should you withdraw now to lock in profits, or wait for potentially greater gains?

Exchange Rates: The Cross-Border Seller's Barometer

For cross-border sellers, exchange rate fluctuations directly impact profit margins. While lower shipping costs this year provided some relief, rising operational expenses and fierce market competition have made it difficult to increase product prices, squeezing profitability. A stronger dollar, however, acts as a lifeline—each dollar converted to yuan translates to higher real earnings.

The Fed's Rate Hikes: Driving the Dollar's Trajectory

U.S. financial analysts anticipate another 75-basis-point Fed rate hike in November, followed by a smaller December increase, potentially pushing rates to 5%. Historical trends show the dollar rallying after each hike. If these moves materialize, where might the exchange rate head next?

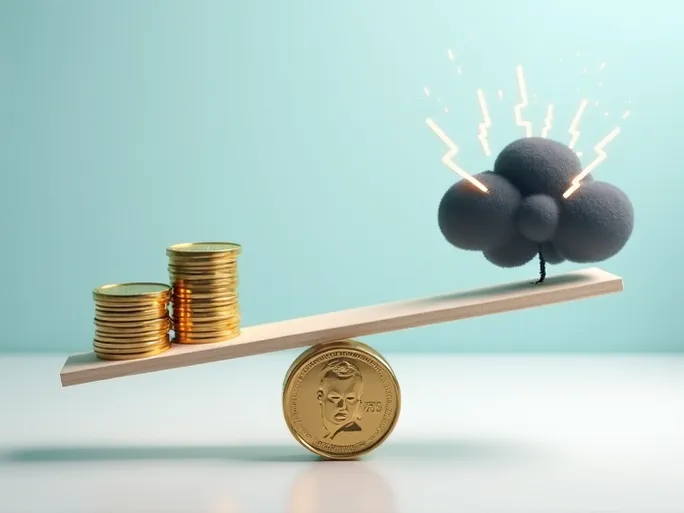

The Cash-Out Conundrum: Weighing Risk and Reward

Some institutions project the USD/CNY rate could reach 7.3 by year-end. At current rates, $100,000 yields 724,000 yuan; waiting for 7.3 would net an extra 6,000 yuan. A jump to 7.4? Even greater gains.

But markets are unpredictable. Should the rate retreat to 7.1 or lower, those paper profits vanish. Deciding when to convert becomes a high-stakes gamble.

Strategy 1: Patience Pays (If You Can Afford It)

For sellers with ample liquidity and no urgent need for yuan, holding out for further dollar strength may be viable—though this assumes tolerance for potential downside.

Strategy 2: Secure Gains When Cash Is King

Those requiring immediate working capital should prioritize certainty. Converting now ensures no catastrophic losses, even if it means leaving some upside on the table.

The Bottom Line: Sovereign Risk Decisions

Ultimately, each seller must assess their financial resilience and risk appetite. Exchange rates defy perfect prediction, making personalized judgment calls essential. In volatile markets, prudence often outweighs greed.