As the dust settles on the year-end shopping season, Amazon has released a summary report claiming its strongest holiday performance in two decades. However, beneath the glossy surface of this announcement lie significant signals about the company's evolving marketplace strategy.

Amazon's official data reveals that third-party sellers accounted for over 60% of total sales this holiday season—a notable increase from last year's 50% share. Small and medium-sized sellers particularly excelled in categories like home goods, beauty products, kitchenware, toys, and apparel, winning consumers with competitive pricing and innovative products. The report highlighted several success stories, including some third-party sellers that achieved 200% to 400% sales growth during the peak fourth quarter, with one board game seller reportedly exceeding 800% growth.

Yet the timing of this report raises questions. Typically released about a week after Cyber Monday, Amazon delayed this year's summary by a full month, ultimately presenting a brief that lacks the detailed category performance metrics and comprehensive data of previous years. Beyond the 60% third-party seller figure, the report omits overall performance data, leaving observers to await Amazon's fourth-quarter earnings report for a complete picture.

The Retreat of Amazon's First-Party Business

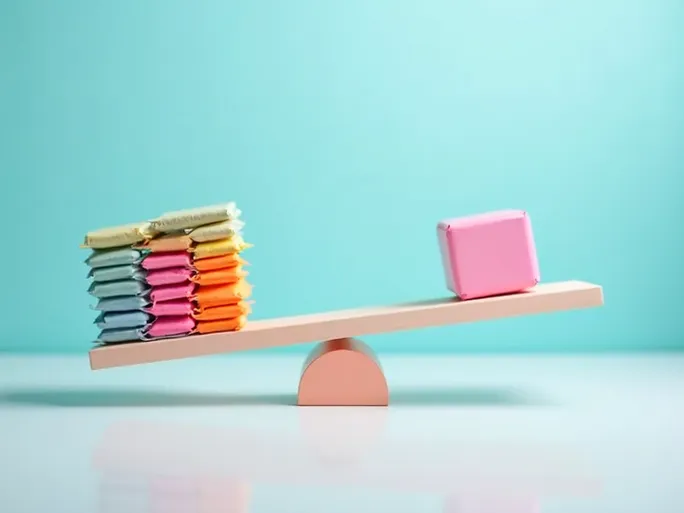

Despite its limitations, the report clearly signals Amazon's gradual retreat from first-party sales. This shift appears driven by both antitrust regulatory pressures and the practical challenges of managing direct sales amid an explosion of third-party sellers. However, this strategic withdrawal may come at a cost to sellers, as Amazon likely compensates by increasing fees across its marketplace services.

Reports indicate that during last year's and this year's holiday seasons, Amazon generated substantial revenue from third-party sellers through various fees—including monthly subscriptions, commissions, FBA (Fulfillment by Amazon) charges, and advertising—totaling at least $121 billion monthly. This represents approximately 34% of sellers' total sales, meaning for every $100 in sales, sellers pay $34 to Amazon. This year saw additional fees like mid-year fuel and inflation surcharges, plus peak-season delivery fees, suggesting even higher take rates. Amazon appears to be transitioning from retailer to pure platform, monetizing through seller fees rather than direct sales.

Impending Fee Increases and Strategic Responses

This evolution may represent part of Amazon's strategy to avoid potential future business breakups. For third-party sellers, however, it presents growing challenges. Several fee adjustments appear likely in 2023:

- Higher advertising costs: As platform competition intensifies, Amazon may increase ad rates or introduce premium ad placements.

- Revised FBA fees: Rising operational costs could lead to adjustments in storage and fulfillment charges.

- Commission restructuring: Category-specific commission rates may be recalibrated to boost platform revenue.

- New premium services: Additional paid services like brand registry, A+ content optimization, or Vine program access may emerge.

Navigating the New Marketplace Reality

Facing Amazon's mounting fee pressure, third-party sellers should consider several strategic responses:

- Operational refinement: Optimizing product listings, enhancing quality, and improving customer service can reduce advertising dependence.

- Channel diversification: Expanding to independent websites or social commerce platforms decreases reliance on Amazon.

- Cost control: Streamlining supply chains and logistics while improving operational efficiency preserves margins.

- Collaborative approaches: Industry associations and seller networks enable knowledge-sharing and collective problem-solving.

While Amazon's holiday report highlights the growing prominence of third-party sellers, it equally signals the platform's transition toward fee-based monetization. As Amazon reshapes its marketplace economics, sellers must adapt strategically to maintain profitability in an increasingly challenging environment.