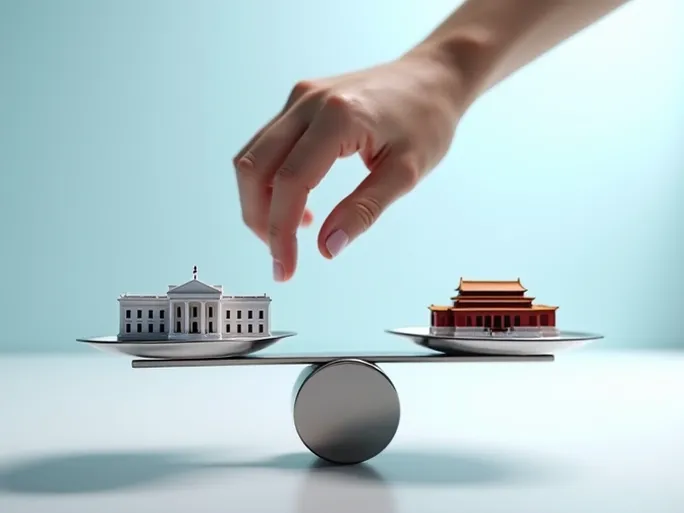

The barometer of global trade continues to sway the nerves of entrepreneurs worldwide. While the recent "confrontational" phase in U.S.-China trade relations left many businesses treading carefully, a glimmer of "dialogue" now appears on the horizon. Recent remarks by U.S. Treasury Secretary Scott Bassent have injected optimism into markets, acknowledging China's fulfillment of negotiated commitments and emphasizing cooperation to achieve trade "rebalancing." Could this signal substantive improvements in U.S.-China trade under a potential Trump 2.0 administration? How should businesses interpret these developments?

I. Positive Signals: A Potential "Thaw" in Trade Relations

Bassent's statements carry significant weight as the lead negotiator on tariffs, representing official efforts to stabilize market expectations and reduce year-end trade uncertainties. Several encouraging developments emerge:

- Strengthened Mutual Trust: U.S. recognition of China's compliance with rare earth regulations and increased soybean purchases reduces trade risks and creates conditions for broader dialogue in technology and energy sectors.

- Global Supply Chain Stability: Eased tensions would help stabilize international supply chains, reducing tariff-related operational costs.

- Market Confidence Boost: Positive market reactions reflect growing optimism about bilateral trade prospects.

II. The "Rebalancing" Strategy: Opportunities and Challenges

Bassent's emphasis on "rebalance" underscores that reducing the U.S. trade deficit with China remains central to American interests:

- Shrinking Trade Deficit: Data shows the U.S. goods trade deficit with China fell 25.2% year-over-year in the first nine months of 2025, with September's monthly deficit plummeting 51.7% from 2024 levels.

- Strategic Adjustments: Businesses should monitor rebalancing measures closely, diversify markets, and enhance operational resilience.

III. Potential Tariff Reductions: Limited Scope, Stringent Conditions

While markets anticipate possible tariff reductions (70-80% probability of 5-10% cuts in 2026), several factors constrain significant changes:

- Revenue Considerations: With $400 billion in total tariff collections since 2025 (below projections), the political value of these revenues remains high.

- Legal Uncertainties: Ongoing Supreme Court review of tariff legality adds policy unpredictability.

- Business Preparedness: Companies should optimize pricing strategies and supply chains to navigate potential adjustments.

IV. Navigating Cross-Border Trade: Key Procedures Explained

Understanding customs processes ("Three Deadlines and Four Clearances") remains essential for international trade:

The "Three Deadlines": Critical Logistics Milestones

- Documentation Deadline (Cut-Off Time): Final submission time for bill of lading materials

- Port Deadline (CY Cutoff): Terminal's cutoff for container acceptance

- Customs Deadline (Closing Time): Final window for customs clearance submissions

The "Four Clearances": Complete Trade Process

- Customs Declaration: Submission of complete goods information

- Customs Clearance: Inspection and approval process

- Customs Conclusion: Final regulatory release

- Full Clearance: Completion of all border procedures

V. Conclusion: Strategic Positioning in Uncertain Times

The evolving U.S.-China trade relationship continues to shape global economic landscapes. Businesses must remain vigilant to policy shifts while strengthening competitiveness to capitalize on emerging opportunities.