Those steel behemoths crisscrossing our oceans carry more than just goods—they transport vital economic signals. Recent data reveals an intriguing divergence in U.S. container imports, painting a nuanced picture of the American economy.

The Container Count: An Economic Barometer

Container freight volumes serve as a real-time economic indicator because:

- Consumer demand: Most containers carry retail goods. Rising volumes suggest strong purchasing power, while declines indicate economic headwinds.

- Manufacturing activity: Industrial components and raw materials signal production levels. Increased shipments correlate with expanding output.

- Global trade: Import/export patterns reflect international economic relationships and domestic consumption trends.

July's Data: Glimmers of Stabilization

According to S&P Global Market Intelligence, July saw U.S.-bound container volumes decline 10% year-over-year—the twelfth consecutive monthly drop, yet the smallest contraction since September 2022. Key details:

- Total imports: 2.53 million TEU (twenty-foot equivalent units)

- 4% monthly increase from June's 2.43 million TEU

- Year-to-date imports down 15% at 16.29 million TEU

This slowing descent resembles a marathon runner nearing the end of an exhausting downhill stretch—the gradient eases before the terrain levels.

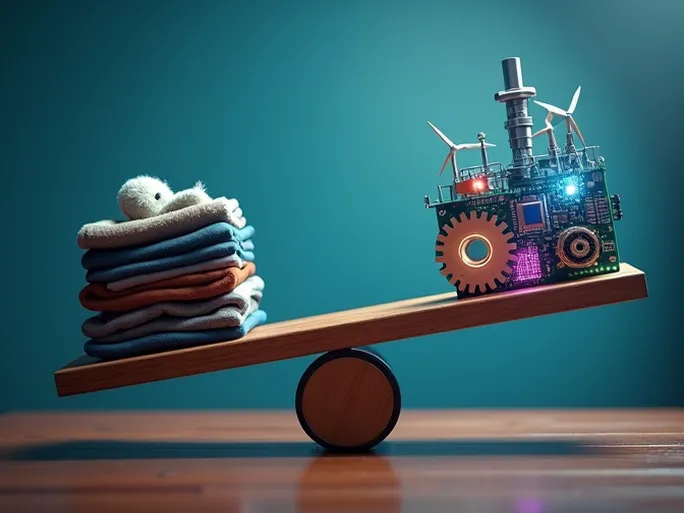

The Great Divergence: Consumer Retreat vs. Industrial Advance

The aggregate numbers conceal a striking sectoral split:

Consumer goods (down 16%):

- Toys/leisure products: -25%

- Apparel: -23%

- Furniture: -20%

Capital goods (up 1%):

- Electrical components: +22%

- Power generation equipment (including renewables): +28%

Root Causes: Inflation Meets Infrastructure

This bifurcation stems from distinct economic forces:

Consumer sector pressures: Persistent inflation squeezes household budgets, while retailers work through pandemic-era inventory gluts. The non-essential goods downturn reflects these dual constraints.

Industrial resurgence: America's infrastructure push—particularly in renewable energy—fuels demand for electrical equipment and construction materials. The Inflation Reduction Act's manufacturing incentives further stimulate this growth.

Expert Insight: A Transitional Phase

Chris Rogers, S&P Global's Supply Chain Research lead, observes: "Twelve straight months of declining imports shouldn't obscure the decelerating pace of deterioration. Economic healing begins when conditions stop worsening."

He notes the economy's dual character—softening consumer markets contrast with expanding industrial activity, suggesting different recovery timelines for each sector.

Global Implications

As the world's largest consumer market, U.S. import trends ripple across global supply chains:

- Weak consumer demand affects export-driven economies

- Strong capital goods demand benefits manufacturing hubs

- Geopolitical factors may reshape trade routes and sourcing patterns

Forward Outlook

The trajectory depends on several variables:

- Inflation moderation and consumer confidence

- Federal Reserve policy decisions

- Global economic conditions

- Infrastructure investment implementation

While challenges persist, the industrial sector's momentum and potential consumer recovery suggest the economic vessel may soon find calmer waters—though navigational vigilance remains essential.