Temu, the international arm of Chinese e-commerce giant Pinduoduo, is rapidly capturing overseas markets, particularly in the United States. Its aggressive pricing strategy combined with extensive marketing campaigns has attracted price-conscious consumers seeking relief from inflationary pressures.

The Temu Advantage: Price Leadership and Customer-Centric Approach

Temu's success stems from several strategic advantages:

- Ultra-low pricing: The platform offers an extensive selection of products at prices significantly below market averages, creating immediate appeal for budget-conscious shoppers.

- Efficient logistics: Temu has established multiple U.S. warehouses to maintain inventory of high-demand products, while implementing streamlined cross-border shipping for other items.

- Generous return policy: The platform's 90-day return window with free return shipping builds consumer confidence in the purchasing process.

Supplier Model: Understanding Temu's Business Framework

Temu operates differently from traditional marketplace platforms like Amazon. Suppliers sell products directly to Temu rather than maintaining independent storefronts. The platform controls pricing, logistics, and marketing, while suppliers receive payment only after customer delivery confirmation.

This model reduces operational complexity for suppliers but comes with significant trade-offs:

- Temu prioritizes products with the lowest prices or most distinctive features for premium placement

- Suppliers face intense pressure to reduce costs, with Temu frequently benchmarking against wholesale prices from platforms like 1688

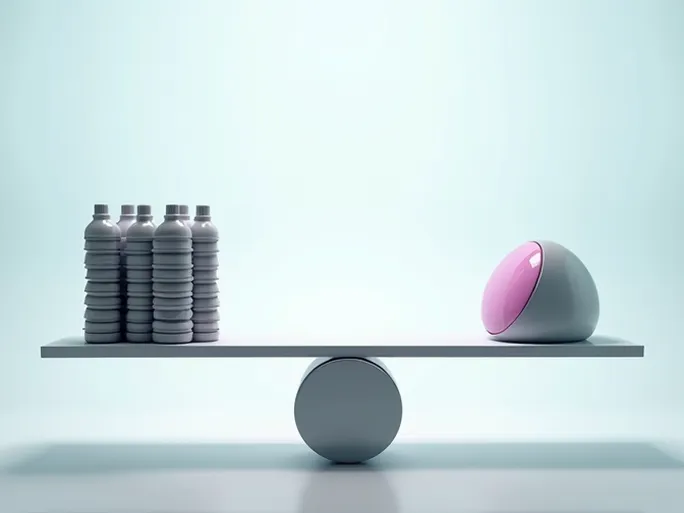

- Profit margins become increasingly compressed as the platform prioritizes growth over supplier profitability

Market Impact and Competitive Considerations

Temu's expansion is reshaping competitive dynamics in several ways:

The platform's aggressive pricing is particularly disruptive for standardized, price-sensitive product categories. Consumer preference for discounted merchandise may draw business away from established platforms, though brand-oriented marketplaces maintain advantages in quality assurance and customer service.

For suppliers, Temu presents both opportunities and challenges:

- Manufacturers with strong production capabilities and cost advantages may benefit from Temu's volume-driven model

- Small and medium sellers without pricing power risk being marginalized in the platform's race to the bottom on price

- The emphasis on commoditized products creates incentives for suppliers to develop differentiated offerings

As e-commerce platforms evolve, suppliers must carefully evaluate their strategic positioning. While Temu offers access to price-sensitive consumers, sustainable success may require balancing platform participation with investments in product innovation and brand development.