Exporting goods to the US through FBA presents various customs declaration challenges. Should you opt for the seemingly convenient third-party declaration, the more standardized agency declaration, or consider self-declaration if you have the capability? Each method has distinct advantages, disadvantages, and suitable applications. This analysis examines these three declaration models to help businesses identify optimal solutions, mitigate risks, and enhance logistics efficiency.

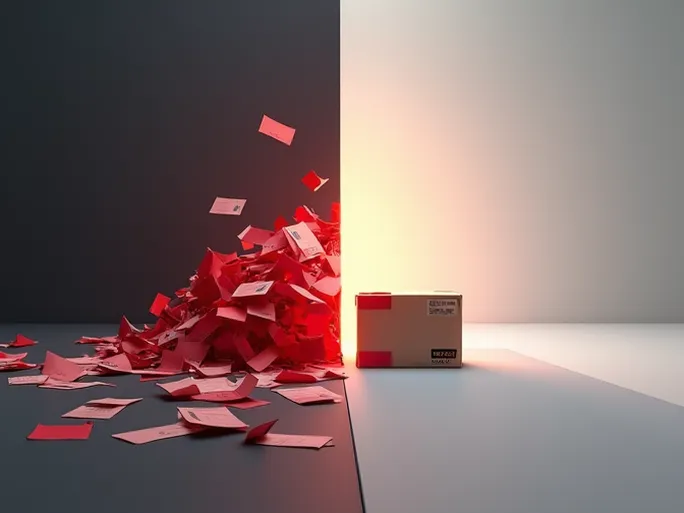

1. Third-Party Declaration: A Fast Track With Hidden Risks?

Third-party declaration involves using another company's import/export license for customs clearance. This approach primarily serves two types of sellers:

- Startups and small-scale sellers: With limited shipment volumes (just a few annually), formal declaration processes may require disproportionate time and cost investments. Third-party declaration simplifies procedures for faster clearance.

- Sellers unable to provide VAT invoices: Without value-added tax invoices, standard export tax rebates become unavailable. For products with low or zero rebate rates, this method avoids invoice-related costs, reducing overall operational expenses.

Important considerations regarding third-party declaration risks:

- Compliance risks: This approach constitutes an irregular declaration method with potential legal consequences. Customs penalties may apply if issues arise.

- Financial security risks: Payments must be made to intermediary companies, creating potential financial vulnerabilities. Selecting reputable agencies becomes critical.

- Ineligibility for export tax rebates: Using another company's license automatically disqualifies sellers from tax rebate benefits.

2. Agency Declaration: Standardized Process With Tax Benefits

Agency declaration entails commissioning licensed foreign trade agencies to handle export procedures. This method suits:

- Companies lacking export qualifications: Businesses without export licenses can maintain regulatory compliance while accessing tax rebates.

- Sellers with complete documentation: Those capable of providing full customs documentation facilitate smoother agency operations.

Advantages of agency declaration include:

- Regulatory compliance: This standardized process meets all legal requirements, minimizing compliance risks.

- Tax rebate eligibility: Sellers can claim export tax rebates, reducing costs and improving profit margins.

- Professional services: Agencies employ specialized teams that enhance clearance efficiency through expertise.

Key considerations when selecting agency declaration:

- Agency reputation: Prioritize established agencies with proven track records to ensure seamless processing.

- Clear contractual terms: Detailed service agreements prevent disputes by clarifying responsibilities.

- Document accuracy: Precise, truthful documentation ensures correct declaration information.

3. Self-Declaration: The Premium Option for Qualified Exporters

Self-declaration requires companies with registered import/export licenses to independently complete customs procedures. Essential prerequisites include:

- Valid import/export license: Companies must possess officially registered export credentials.

- Certified customs specialists: In-house staff must thoroughly understand customs protocols.

- Declaration systems: Dedicated software facilitates efficient declaration management.

Self-declaration benefits encompass:

- Full process control: Complete oversight improves efficiency and reduces costs.

- Data security: Eliminates third-party commercial information exposure.

- Expertise development: Builds institutional knowledge and professional capabilities.

Conclusion: Selecting Your Optimal Declaration Method

Each declaration model presents unique advantages for different FBA sellers. The optimal choice depends on business scale, qualifications, budget constraints, and risk tolerance. Businesses lacking relevant credentials should consider professional freight forwarders or customs brokers for agency declarations, or evaluate third-party options. Professional handling remains essential for ensuring efficient clearance and successful FBA warehouse deliveries.