The latest data from the Association of American Railroads (AAR) reveals a complex picture of the U.S. rail freight market, with modest growth in some sectors offset by concerning declines in others.

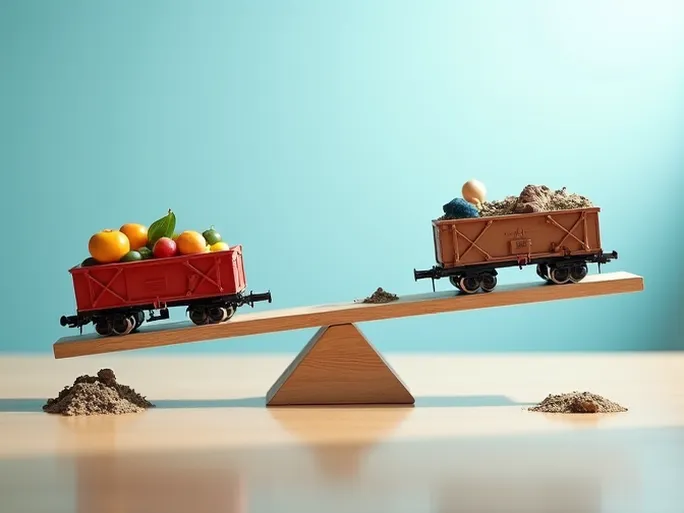

A Divergent Performance

For the week ending March 12, U.S. rail freight volume reached 232,338 carloads, showing a 0.9% increase year-over-year. However, this marginal growth masks significant sectoral variations:

- Growth Leaders: Chemicals (+5,958 carloads to 35,933), nonmetallic minerals (+1,339 to 30,466), and coal (+485 to 64,589) demonstrated resilience, reflecting continued industrial demand.

- Declining Sectors: Grain shipments fell by 2,726 carloads to 21,213, petroleum products dropped 1,374 to 10,005, while automotive shipments decreased by 900 to 13,936.

Intermodal Challenges Deepen

More concerning is the 9.1% year-over-year decline in intermodal traffic, with only 263,746 containers and trailers moved during the reporting period. This continues a troubling trend observed throughout 2022's first ten weeks, where cumulative intermodal volume fell 7.2% despite a 3.2% increase in total rail carloads.

North American Context

The broader North American rail network shows similar pressures, with 12 major railroads across the U.S., Canada and Mexico reporting a 1.2% decline in total carloads and an 8.1% drop in intermodal units for the same period.

Structural Challenges Emerge

Industry analysts identify several key factors influencing these trends:

- Persistent Supply Chain Disruptions: Port congestion, trucker shortages, and warehouse capacity limitations continue to constrain efficiency.

- Shifting Demand Patterns: The transition toward renewable energy impacts traditional sectors like coal and petroleum while boosting minerals for construction and manufacturing.

- Geopolitical Uncertainty: The Russia-Ukraine conflict has disrupted global trade flows and energy markets.

- Intermodal Competition: Trucking's flexibility for short-haul shipments and infrastructure limitations challenge rail's intermodal competitiveness.

Pathways Forward

Rail operators are pursuing multiple strategies to address these challenges:

- Modernizing aging infrastructure to improve capacity and reliability

- Implementing IoT and AI solutions to optimize operations

- Developing sustainable technologies to align with climate priorities

- Expanding service offerings to include warehousing and logistics solutions

- Strengthening partnerships across the transportation ecosystem

While the current environment presents significant headwinds, the rail industry's fundamental advantages in moving bulk commodities and containerized freight position it to adapt to evolving market conditions. The coming months will test operators' ability to navigate both cyclical pressures and structural transformations in the North American supply chain.