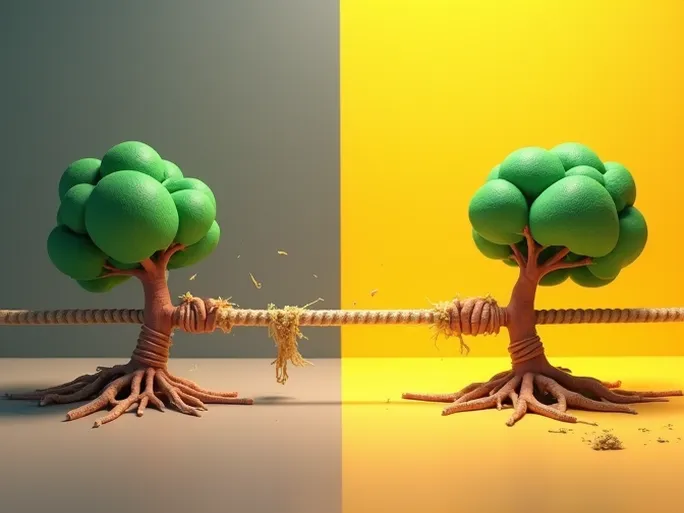

As retailers worldwide grapple with soaring transportation costs and supply chain bottlenecks, two discount retail giants—Dollar Tree and Dollar General—are demonstrating markedly different approaches to these unprecedented challenges. While both companies built their success on low-price strategies, their current trajectories reveal critical differences in business models and supply chain resilience.

Dollar Tree: The Strains of a Fixed-Price Model

Dollar Tree's signature "everything $1" strategy, once its greatest strength, has become its most significant vulnerability in the current economic climate. The company anticipates $185 to $200 million in additional freight costs this year, potentially reducing earnings per share by up to $1.60—a substantial blow to profitability.

Compounding these financial pressures, the retailer faces severe shipping reliability issues. CEO Mike Witynski revealed that expectations for container shipping fulfillment have dropped from 85% to just 60-65%. "We believe Dollar Tree imports more containers per $100 million in sales than other major retailers," Witynski explained during an earnings call, highlighting the company's disproportionate exposure to freight costs.

A particularly striking example illustrates these challenges: one of Dollar Tree's chartered vessels was denied entry to China due to a crew member's positive COVID-19 test, forcing a two-month detour to Indonesia for a complete crew replacement before continuing its journey.

Dollar General: A More Flexible Approach

In contrast, Dollar General appears better positioned to weather the storm. While acknowledging inflationary pressures, executives mentioned "freight costs" only eight times during their Q2 earnings call—compared to 41 mentions in Dollar Tree's discussion.

CFO John Garratt characterized the transportation challenges as "transitory" while maintaining stable earnings projections and even raising sales expectations. This resilience stems partly from pandemic-driven demand for essential goods at convenient locations, but also reflects fundamental differences in business strategy.

Performance Divergence

The companies' recent results underscore their divergent paths:

- Dollar General reported a modest 0.4% year-over-year sales decline to $8.7 billion, which analysts consider expected given 2020's exceptional performance.

- Dollar Tree posted 1% overall sales growth to $6.3 billion, but this masks concerning trends—a 0.2% same-store sales decline at Dollar Tree locations and a 2.1% drop at Family Dollar stores.

Strategic Differences

Three key factors explain the companies' differing fortunes:

1. Pricing Flexibility: Dollar General's diversified price points allow better cost absorption compared to Dollar Tree's rigid $1 structure.

2. Supply Chain Management: While details remain undisclosed, Dollar General likely maintains stronger carrier relationships and inventory systems.

3. Customer Base: Dollar General benefited more from pandemic shopping patterns, as customers consolidated trips to neighborhood stores for essentials.

Broader Implications for Retail

The contrasting experiences of these discount retailers offer valuable lessons for the broader industry:

- Fixed-price models become increasingly vulnerable during inflationary periods

- Supply chain diversification is no longer optional but essential

- Localized retail formats may retain pandemic-era gains better than expected

As global supply chains face continued uncertainty, retailers must balance short-term adaptations with long-term strategic shifts. The current crisis underscores that price leadership alone cannot guarantee success—operational flexibility and supply chain resilience have become equally critical competitive advantages in today's volatile retail environment.