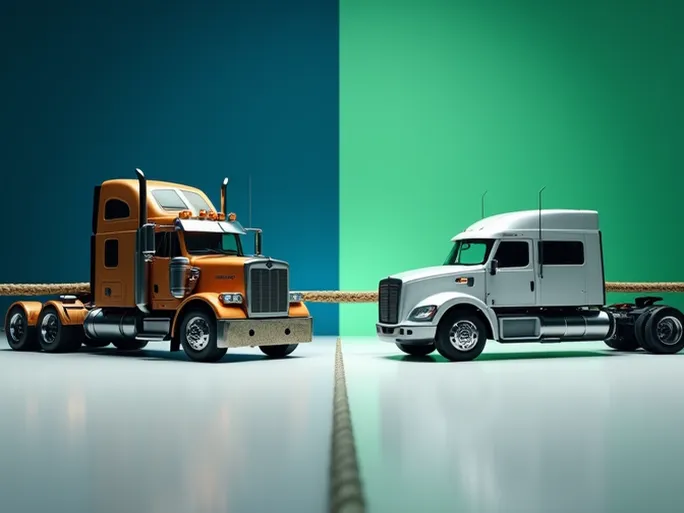

In today's global economic environment, supply chain stability and efficiency are critical to business success. However, with persistent capacity constraints, companies face unprecedented challenges. Can traditional contract carriage models meet growing demands? Armstrong & Associates' latest report provides insights into two evolving solutions: Dedicated Contract Carriage (DCC) and Dedicated Truckload Capacity (DTC).

The Transportation Model Dilemma: Tradition vs. Innovation

Armstrong & Associates defines Dedicated Truckload Capacity (DTC) as carriers committing to provide continuous capacity on specific routes while allowing equipment sharing across clients. This model saw remarkable 30.6% growth in 2020, reaching $6.3 billion in net revenue.

In contrast, Dedicated Contract Carriage (DCC) represents a traditional, asset-intensive approach where specific transportation assets are exclusively allocated to individual clients. While DCC generated $20 billion in 2020 (its second-highest historical revenue), growth slowed to 0.3% from 12.1% in 2019, partly due to pandemic-related volume declines.

Dedicated Contract Carriage (DCC): A Proven Solution

DCC offers shippers a reliable method to secure capacity and ensure supply chain stability through long-term contracts (typically 1-3 years) that specify asset allocations. Key advantages include:

- Stability: Guaranteed capacity prevents supply chain disruptions

- Expert Management: Often overseen by third-party logistics providers (3PLs) with route optimization expertise

- Specialization: Custom solutions for unique cargo requirements

DCC Implementation Process

- Demand Analysis: Evaluate shipment types, volumes, frequencies, and destinations

- Contract Execution: Define asset allocations, routes, service agreements, and pricing

- Asset Deployment: Assign and maintain dedicated transportation equipment

- Transport Management: 3PLs handle routing, scheduling, and tracking

- Performance Review: Regular evaluations and adjustments

Ideal DCC Applications

- High-value goods requiring security

- Time-sensitive deliveries

- Specialized cargo needing unique equipment

- Long-term transportation needs

Dedicated Truckload Capacity (DTC): The Flexible Alternative

DTC emphasizes route-specific capacity guarantees while enabling equipment sharing across clients. Its pay-per-use model and resource flexibility offer distinct advantages:

- Dynamic resource allocation maximizes asset utilization

- Scalability accommodates demand fluctuations

- Cost efficiency through shared infrastructure

DTC Operational Framework

- Transportation needs assessment

- Capacity reservation based on demand

- Resource allocation by carriers

- Transport execution and delivery

- Usage-based billing

Optimal DTC Use Cases

- Seasonal demand variations

- Irregular shipping patterns

- Rapidly growing businesses

- Cost-conscious organizations

Comparative Analysis: DCC vs. DTC

| Feature | Dedicated Contract Carriage (DCC) | Dedicated Truckload Capacity (DTC) |

|---|---|---|

| Asset Commitment | Exclusive client allocation | Shared across multiple clients |

| Contract Duration | 1-3 years | Short-term or on-demand |

| Cost Structure | Higher but stable | Lower but variable |

| Flexibility | Limited adaptability | High responsiveness |

| Capacity Assurance | Guaranteed availability | Subject to shared demand |

Industry Adoption Patterns

Traditional sectors like food/grocery, retail, automotive, and home goods typically prefer DCC for store deliveries and distribution center transfers. Conversely, e-commerce, technology, and healthcare industries increasingly adopt DTC for its flexibility.

Case Study: Food Retailer

A national grocery chain implemented DCC for daily perishable deliveries, contracting dedicated refrigerated trucks to ensure consistent store replenishment and product freshness.

Case Study: E-Commerce Provider

A fast-growing online retailer adopted DTC to handle fluctuating order volumes, dynamically adjusting capacity through multiple carrier partnerships to meet customer demand peaks.

Strategic Considerations for Capacity Challenges

With persistent driver shortages and port congestion, Armstrong & Associates recommends:

- Diversifying transportation modes (DCC, DTC, LTL, TL)

- Establishing core carrier networks

- Optimizing routes through advanced TMS solutions

- Improving load efficiency

- Implementing predictive planning

- Leveraging IoT and AI technologies

The Road Ahead

As Evan Armstrong, president of Armstrong & Associates, observes: "DCC remains effective for asset control commitments, while DTC's growth reflects market demand for flexible capacity solutions." The choice between models ultimately depends on operational priorities—DCC's reliability versus DTC's adaptability.

Successful supply chain management requires holistic strategies incorporating both traditional and innovative approaches, complemented by digital transformation and sustainability initiatives. In an era of uncertainty, the ability to balance stability with flexibility will separate industry leaders from the competition.