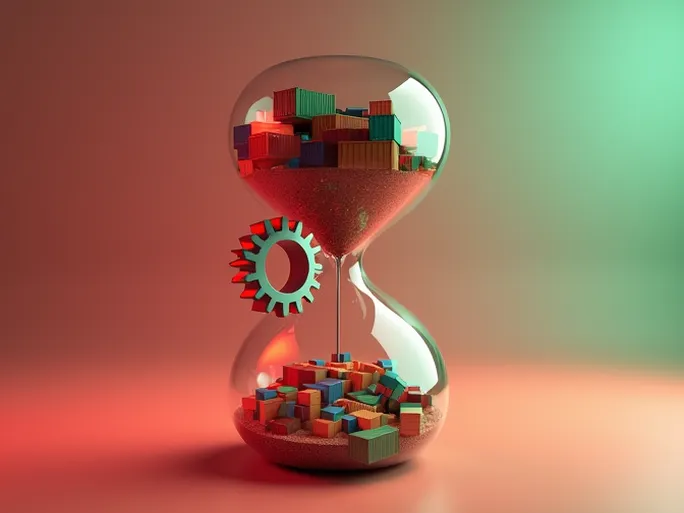

The logistics industry faces unprecedented challenges as unloading delays at intermodal facilities have skyrocketed by 70% compared to 2019 levels, according to recent disclosures from Schneider National. This alarming trend threatens to disrupt supply chains across multiple sectors, forcing transportation providers to implement innovative solutions.

The Growing Crisis in Intermodal Logistics

Mark Rourke, President and CEO of Schneider, revealed during the company's Q2 earnings call that customers now experience significantly longer dwell times when unloading intermodal containers. Industry analysts attribute this bottleneck to three primary factors:

- Freight volume surges: Record demand continues to strain existing infrastructure

- Labor shortages: Persistent workforce gaps across transportation sectors

- Rail ramp congestion: Network-wide bottlenecks at key intermodal facilities

The consequences of these delays ripple through supply chains, creating:

- Reduced profit margins from slower inventory turnover

- Increased operational costs including detention fees

- Damaged customer relationships due to late deliveries

- Disrupted production schedules throughout manufacturing networks

Industry-Wide Response to Capacity Constraints

Major players across the transportation sector are implementing countermeasures. J.B. Hunt Transport Services reports strong demand for intermodal services that "far exceeds available capacity," according to Darren Field, Executive Vice President of Intermodal. Meanwhile, Class I railroads BNSF and Union Pacific have instituted temporary service adjustments to manage network constraints.

Schneider has positioned itself to address these challenges through several strategic initiatives:

- Planned addition of 1,500-3,000 containers by year-end

- Advanced tracking technology for real-time shipment visibility

- Maintaining control over 90% of short-haul transportation assets

- Collaborative programs to improve container turnaround times

Sustainability Goals and Future Growth

The company has established ambitious environmental targets, aiming to double its intermodal business within eight to nine years while reducing carbon emissions by 700 million pounds annually by 2030. Schneider views intermodal as a key growth sector, combining cost efficiency with environmental benefits through optimized rail utilization.

Industry observers note that successful intermodal expansion requires coordinated efforts between transportation providers, rail operators, and government entities. Infrastructure investments and policy support will prove critical in developing solutions that maintain fluidity throughout supply chains while meeting sustainability objectives.

As supply chain disruptions continue to challenge global commerce, Schneider's approach highlights the importance of asset control, technological integration, and collaborative relationships in overcoming intermodal constraints. The company's strategy focuses on creating resilient networks capable of withstanding current pressures while positioning for future growth in this critical transportation sector.