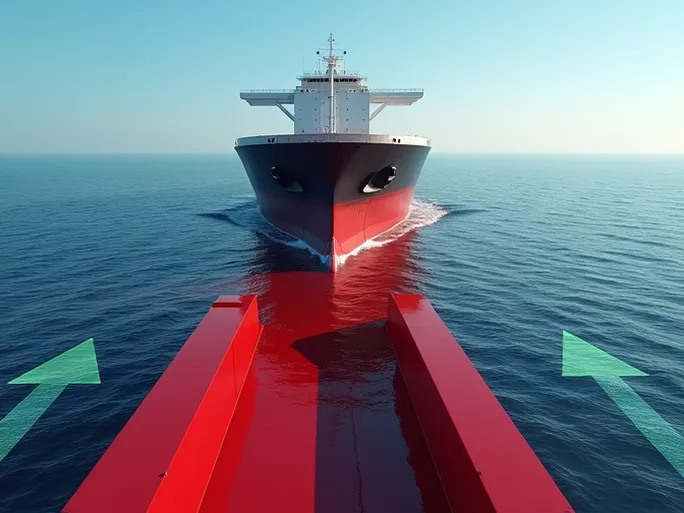

Imagine a colossal vessel laden with valuable cargo from across the globe, meticulously scheduled to arrive at a bustling port precisely on time to unload before embarking on its next journey. Yet reality often falls short of expectations. At the ports of Los Angeles and Long Beach—America's two most critical West Coast gateways—this scenario has become an alarming nightmare.

Persistent congestion has forced these maritime giants into prolonged waits at sea, trapped in invisible traffic jams. Delivery timelines face relentless delays, threatening to unravel tightly synchronized supply chains. For businesses reliant on these ports for trade, this transcends mere logistics—it represents an existential challenge.

California's Port Bottleneck: The Achilles' Heel of Global Commerce

The twin ports of Los Angeles and Long Beach have long shouldered immense freight pressure as vital conduits between Asia and North America. Daily, countless containers transfer between ships, railroads, and trucks destined for American consumers. But mounting congestion has transformed these hubs into the supply chain's weakest link.

Extended vessel dwell times and mountainous container stacks create labyrinthine bottlenecks. Every supply chain segment suffers—from raw material procurement to final product delivery—each vulnerable to delays and uncertainty. These disruptions inflate transport costs, risk production shutdowns, and potentially degrade consumer experiences.

Consider an automaker idling factories awaiting critical components, a retailer missing seasonal sales due to delayed inventory, or a café unable to serve customers because coffee beans languish offshore. Such seemingly minor delays can trigger cascading economic consequences.

Charting New Courses: How Retail Titans Are Adapting

Confronting California's port gridlock, major retailers are pioneering alternatives—redirecting freight through less congested harbors. This strategic pivot demands robust resource coordination and agile supply chain management, requiring deep analysis of global port networks, transit routes, and logistics economics.

"For companies already distributing cargo across multiple ports, adjusting volumes is relatively straightforward," explains Jason Totah, President of Odyssey International Services. These enterprises maintain diversified port footprints, allowing dynamic adjustments like chess masters maneuvering pieces against shifting challenges.

Retail behemoths like Walmart and Target exemplify this approach. Their vast distribution networks and logistics prowess enable real-time port allocation adjustments, mitigating congestion risks like conductors harmonizing an orchestra's sections.

Walmart's Multi-Port Strategy

Walmart's harbor utilization offers a textbook case. The corporation imports through over a dozen ports, with Houston and Seattle as primary gateways. This diversification mirrors savvy investment portfolios—spreading risk while enhancing responsiveness.

When one port falters, Walmart swiftly reroutes cargo, ensuring uninterrupted operations. Such flexibility proves indispensable against market volatility and unexpected disruptions.

The Rise of Northwest Seaport Alliance

The Northwest Seaport Alliance (combining Seattle and Tacoma ports) emerges as a viable alternative to Southern California's logjams. These Pacific Northwest facilities boast advanced infrastructure and efficient operations, supported by robust rail connections to Midwest markets.

For shipments destined to Ohio or Kentucky, shifting cargo northward proves strategic. "70% of our Midwest-bound freight moves by rail," notes Todd Carter, BNSF Railway Vice President, whose services provide critical connectivity for time-sensitive shipments.

CMA CGM's New Route: Easing Southern California Pressure

Adding capacity, CMA CGM recently launched a direct Asia-Northwest Seaport Alliance route. "This service helps alleviate Southern California strain," affirms Fred Felleman, Seattle Port Commission President, anticipating improved system-wide efficiency through cargo redistribution.

Building Supply Chain Immunity

Totah advocates constructing resilient supply chains capable of port-hopping flexibility. Large enterprises can pivot swiftly by instructing freight brokers—like seasoned travelers selecting alternate transit options.

When evaluating switches, delivery timelines become critical KPIs. If inventory shortages risk factory stoppages, port diversification likely outweighs costs. Conversely, tolerable delays may not justify rerouting expenses—each scenario demands meticulous cost-benefit analysis.

Digital Transformation: Illuminating the Supply Chain

Beyond physical rerouting, digital technologies revolutionize supply chain visibility. IoT sensors track cargo conditions in real-time, while AI-driven analytics predict disruptions and optimize routes—enhancing efficiency, reducing costs, and elevating customer satisfaction.

Sustainable Harbors: The Green Port Revolution

Environmental stewardship gains traction as ports adopt renewable energy, emission controls, and resource recycling. These green initiatives not only protect ecosystems but also boost competitiveness by attracting eco-conscious partners.

Regional Synergy: Crafting Collaborative Networks

Inter-port cooperation grows increasingly vital. Shared data platforms, synchronized procedures, and coordinated strategies forge high-efficiency logistics ecosystems that elevate regional competitiveness and investment appeal.

Policy Foundations: Enabling Port Prosperity

Government support remains pivotal. Streamlined regulations, infrastructure funding, and expedited approvals cultivate business-friendly environments that stimulate port growth and sustainability.

Cultivating Talent: The Human Infrastructure

Skilled workforces underpin port success. Continuous training in emerging technologies and operational best practices builds adaptable teams ready to navigate evolving trade landscapes.

Risk Mitigation: Preparing for the Unexpected

From natural disasters to cyber threats, comprehensive risk frameworks—including contingency plans and stress testing—fortify supply chains against unpredictable shocks.

Horizon Scan: The Future of Intelligent Supply Webs

As global trade dynamics evolve, integrating port flexibility, digital tools, sustainability, and collaboration will define tomorrow's supply chains. California's congestion crisis serves as both warning and catalyst—compelling innovation to meet coming challenges.

This supply chain transformation will reshape global commerce, forging more efficient, intelligent, and sustainable systems that drive economic prosperity while safeguarding planetary resources.