When you place an online order for groceries or household essentials on Walmart's website or app, have you ever wondered how these items reach you with such speed and efficiency? The answer may lie in Walmart's aggressive push toward "Micro-Fulfillment Centers" (MFCs) - highly automated facilities that are becoming a crucial component in optimizing e-commerce order fulfillment and enhancing customer experience.

Micro-Fulfillment Centers: The New Retail Infrastructure

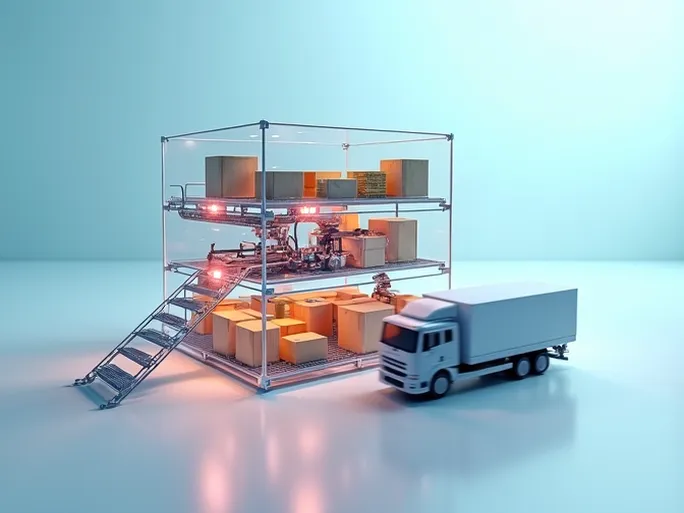

Micro-Fulfillment Centers are compact, automated order fulfillment facilities typically located within or near existing retail stores. Unlike large, centralized fulfillment centers, MFCs are designed to reduce order processing times and lower transportation costs, particularly for time-sensitive goods like fresh groceries and daily essentials. Their emergence represents retailers' response to rapid e-commerce growth and consumers' increasing demand for fast, convenient delivery.

Walmart's MFC Strategy: Multiple Technological Approaches

Walmart is actively exploring various MFC technological solutions, planning to install automated micro-fulfillment centers in dozens of stores. While the company hasn't disclosed specific rollout timelines or store locations, it has confirmed partnerships with multiple technology providers including Alert Innovation, Dematic, and Fabric to test different configurations. This multi-pronged technological approach reflects Walmart's cautious yet pragmatic stance in automation adoption.

The retail giant is implementing MFCs in diverse formats. Some centers are being built within existing stores to maximize space utilization, while others are constructed as adjacent facilities to expand fulfillment capacity. Additionally, Walmart is introducing automated pickup points at select locations where customers can drive up, scan a QR code, and quickly retrieve their orders.

Technology Partners: Alert Innovation, Dematic, and Fabric

Walmart's collaboration with multiple technology providers aims to comprehensively evaluate different systems and identify optimal solutions for its operations.

- Alert Innovation: The company's core technology is Alphabot, an autonomous mobile robotic system that rapidly stores and retrieves products within fulfillment spaces, significantly accelerating order processing.

- Dematic: As a provider of comprehensive automation solutions spanning warehousing, conveying, and sorting systems, Dematic helps Walmart build more complete and efficient fulfillment infrastructure.

- Fabric: Fabric's MFC solutions stand out for their flexibility, requiring as little as 5,000 square feet of space, enabling urban deployments that further reduce delivery times.

Tom Ward, Walmart's senior vice president of customer product, stated in a company blog post: "Through these partnerships, we'll test different configurations and additional innovations to learn what works best in different environments."

Pilot Program: Lessons from Salem, New Hampshire

Walmart's automation testing began as early as 2019 at a Salem, New Hampshire store in collaboration with Alert Innovation. The facility employs robotic systems for product storage and retrieval, while human associates assemble orders and select fresh produce or bulky items unsuitable for automated handling.

According to Ward, Walmart employees will continue selecting these supplemental items from store shelves, maintaining consistency with current pickup and delivery practices. "We've always said personal shoppers are our secret sauce for pickup and delivery, and that remains true. So when the system retrieves an order for assembly, a personal shopper will handpick fresh items like produce, meat, and seafood, plus oversized general merchandise from the sales floor," Ward explained.

The Salem pilot demonstrated significant improvements, enabling one-hour pickup or delivery windows while increasing available shopping time slots. The facility also enhanced efficiency by fulfilling orders for multiple stores.

Expansion Plans: Texas as Next Frontier

During recent earnings calls, Walmart executives revealed plans to extend micro-fulfillment testing to Texas, though specific project scale or timelines weren't disclosed. This move signals growing confidence in MFC technology and intentions for broader implementation.

Industry Competition: The MFC Race Among Retail Giants

Walmart isn't alone in exploring micro-fulfillment technology. Competitors like Albertsons and Ahold Delhaize have launched their own MFC pilots. However, with its massive scale, substantial resources, and advanced technological infrastructure, Walmart is positioned to maintain industry leadership.

The retailer currently offers pickup services at approximately 3,500 locations and same-day delivery at about 2,700 stores. Its Walmart+ membership program includes unlimited free delivery, while autonomous delivery technology tests - including "middle-mile" facility transfers - may eventually integrate with automated fulfillment systems.

Automated Pickup: Enhancing Customer Convenience

Walmart's recently announced automated pickup points represent another technological initiative. Conceptual images reveal drive-through self-service kiosks offering an alternative to current pickup methods requiring designated parking spots and in-store assistance.

While Walmart already operates automated pickup towers in hundreds of stores (incapable of storing perishables), retailers are actively innovating in this space. Albertsons installed an automated pickup kiosk at a Chicago Jewel-Osco location last December, while others are expanding locker systems and tracking technologies to monitor customer arrivals.

MFC Advantages and Challenges

As emerging retail infrastructure, micro-fulfillment centers offer several benefits:

- Faster fulfillment: Proximity to consumers dramatically reduces processing and delivery times.

- Lower transportation costs: Reduced long-haul shipping improves profitability.

- Improved inventory turnover: More efficient stock management minimizes overstock and waste.

- Enhanced customer experience: Quick, convenient service boosts satisfaction and loyalty.

However, MFC deployment faces obstacles:

- High initial investment: Automated equipment requires substantial capital.

- Technical complexity: Operations demand sophisticated robotics, software, and analytics.

- Space constraints: Finding suitable in-store or adjacent locations presents challenges.

- Workforce management: Requires specially trained personnel for maintenance and operation.

Future Outlook: Automation Trends in Fulfillment

As e-commerce grows and consumers increasingly prioritize speed and convenience, automated fulfillment will become retail's inevitable direction. Micro-fulfillment centers will play an expanding role as key components of this automated future.

Future MFCs will likely become more intelligent and automated, incorporating AI, machine learning, and IoT technologies to improve efficiency and reduce costs. Deployment models will grow more flexible to accommodate diverse retailer needs and market conditions.

Walmart's proactive MFC experimentation provides valuable industry insights. As technology advances and costs decline, automated fulfillment will gradually proliferate, ultimately benefiting consumers.