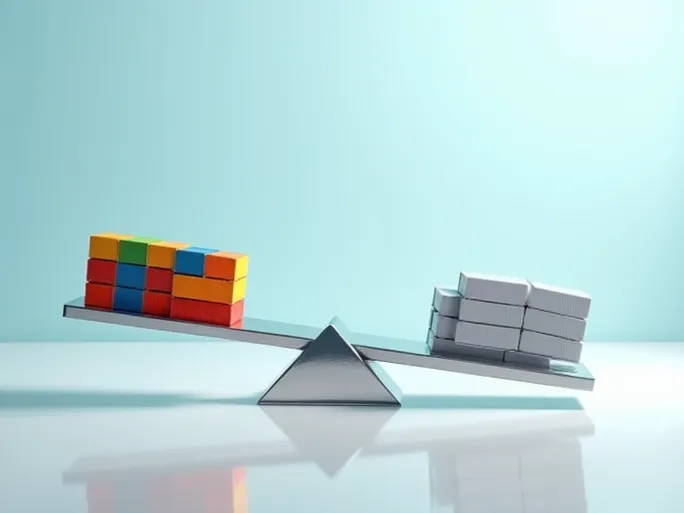

Imagine the lifeblood of global trade—shipping containers—racing between ports at astonishing speeds. Yet this bustling transportation network faces significant supply-demand imbalances. Wolfgang Schoch, Operations Director at Hapag-Lloyd, recently stated that the container market may need two more years to regain equilibrium. What developments can we expect in the shipping industry during this period, and how might they affect our daily lives?

Speaking at a cargo logistics conference in Vancouver, Schoch predicted the container market would achieve relative balance around 2019. This equilibrium would occur when market demand finally keeps pace with capacity growth. He emphasized that maintaining steady capacity expansion while retiring older vessels would be crucial to gradually bridging the supply-demand gap. In other words, the industry needs "measured growth" rather than uncontrolled expansion.

The next two years will see approximately 3.2 million TEUs (twenty-foot equivalent units) of new capacity enter the market—a development that will undoubtedly pressure the industry. However, Schoch anticipates that major liner companies will refrain from placing substantial new orders after this period. This expectation stems from the gradual impact of industry consolidation, which will become more apparent post-2018, reducing carriers' need to optimize fleet structures.

Hapag-Lloyd itself is nearing completion of its merger with United Arab Shipping Company's fleet, while Maersk's acquisition of Hamburg Süd will bring additional capacity. Such consolidation efforts effectively decrease demand for new vessels. "Other companies are undergoing similar mergers and acquisitions," Schoch noted. "Under these circumstances, optimizing existing fleets proves more cost-effective than building new ones. Moreover, even if companies sought financing for new vessels, they would face significant constraints."

The container shipping market remains in a transitional phase. While overcapacity persists in the short term, industry consolidation, controlled capacity growth, and vessel retirements may gradually restore balance within two years. For consumers, this suggests shipping rates will likely stabilize—neither soaring nor plummeting dramatically. For carriers, the challenge lies in managing capacity with greater precision to remain competitive in an increasingly consolidated market.