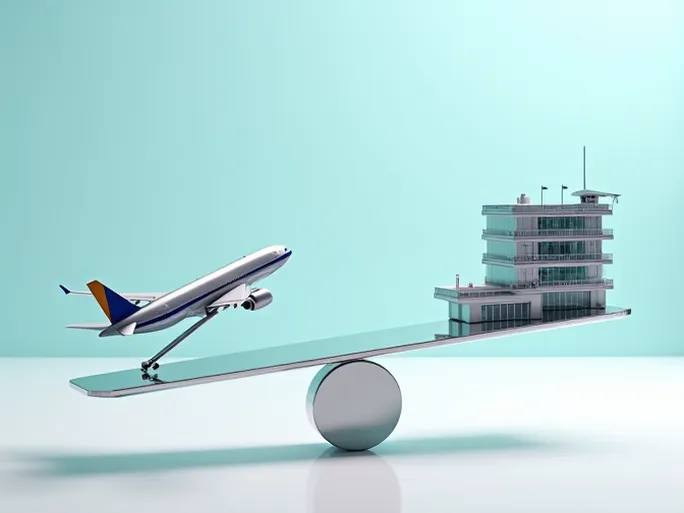

GENEVA/NEW YORK — A groundbreaking report from the International Air Transport Association (IATA) and McKinsey & Company exposes profound imbalances in profit distribution across aviation's value chain, raising urgent questions about the sector's long-term sustainability. The analysis shows airlines consistently underperforming while airports, distribution systems, and service providers maintain healthier margins—a disparity exacerbated by the pandemic.

The Pre-Pandemic Landscape: Chronic Underperformance

Between 2012-2019, airlines generated operating profits but failed to meet investor expectations, with average returns on invested capital (ROIC) lagging weighted average cost of capital (WACC) by 2.4%—equivalent to $17.9 billion in annual capital destruction. This persistent shortfall contrasts sharply with other value chain segments:

- Airports outperformed WACC by 3% ($4.6 billion annually)

- Global Distribution Systems (GDS) and travel tech firms achieved 8.5% returns ($700 million)

- Ground handlers delivered 5.1% margins ($1.5 billion)

- Air navigation providers maintained 4.4% returns ($1 billion)

Pandemic Shockwaves: Accelerating Imbalances

The COVID-19 crisis magnified structural weaknesses, with airlines suffering ROIC deficits of -20.6% ($104 billion) compared to airports' -39.5% ($34 billion). Notably:

- Full-service carriers initially outperformed low-cost airlines during the crisis

- Cargo-only operators maintained near 10% ROIC, though still trailing freight forwarders' 15-40% returns

- North American airlines demonstrated strongest pre-crisis balance sheets and fastest recovery trajectories

Root Causes: An Industry Designed for Struggle

Harvard Business School's Michael Porter identified enduring challenges in 2011 that remain largely unchanged:

- Hyper-competition: Low entry barriers, high exit costs, and relentless price wars

- Supplier power: Concentrated aircraft/engine manufacturers and fuel providers

- Buyer fragmentation: Price-sensitive customers with low switching costs

- Product commoditization: Limited differentiation beyond price

Public opinion aligns with regulatory concerns—85% of consumers across 11 nations believe airport charges should face utility-style oversight, per IATA surveys.

Pathways to Equilibrium: Data and Decarbonization

The report identifies two collaborative opportunities that could benefit all stakeholders:

1. Operational Data Integration

Shared analytics could optimize infrastructure planning, crew scheduling, and runway utilization. Early airport trials demonstrate efficiency gains from coordinated decision-making.

2. Net-Zero Transition

Achieving 2050 decarbonization requires unprecedented cooperation:

- Affordable sustainable aviation fuel (SAF) production scaling

- ANSP-optimized flight paths

- Next-gen aircraft development (hydrogen/electric propulsion)

- Airport electrification (ground vehicles/services)

Sector-Specific Profitability Analysis

Airlines: The Vulnerable Core

Despite generating $560 billion in annual pre-pandemic revenue, airlines face:

- Fuel price volatility (30-40% of operating costs)

- Rigid aircraft acquisition/leasing expenses

- Labor-intensive operations with high unionization

- Infrastructure fees consuming 15-20% of revenue

Airports: The Resilient Monopolies

Regional monopolies enjoy:

- Dual revenue streams (aeronautical/commercial)

- Captive customer bases

- Long-term concession agreements

- Retail/real estate income diversification

Technology Intermediaries: The Silent Winners

GDS and travel tech platforms benefit from:

- Transaction-based fee structures

- High switching costs for airlines

- Data network effects

- Scalable digital infrastructure

Post-Pandemic Rebalancing

The crisis presents opportunities for structural reform:

- Digital transformation: AI-driven demand forecasting and personalized services

- Sustainability investments: Fleet modernization and SAF adoption

- Regulatory modernization: Monopoly oversight and competition policies

- Ecosystem collaboration: Shared data platforms and joint infrastructure planning

As McKinsey partner Nina Wittkamp observed: "The value chain has never collectively exceeded capital costs. But win-win scenarios exist—deeper cooperation can better serve consumers while creating sustainable value."

The aviation industry stands at an inflection point, where addressing these structural imbalances may determine its ability to meet growing travel demand while achieving environmental and financial sustainability.