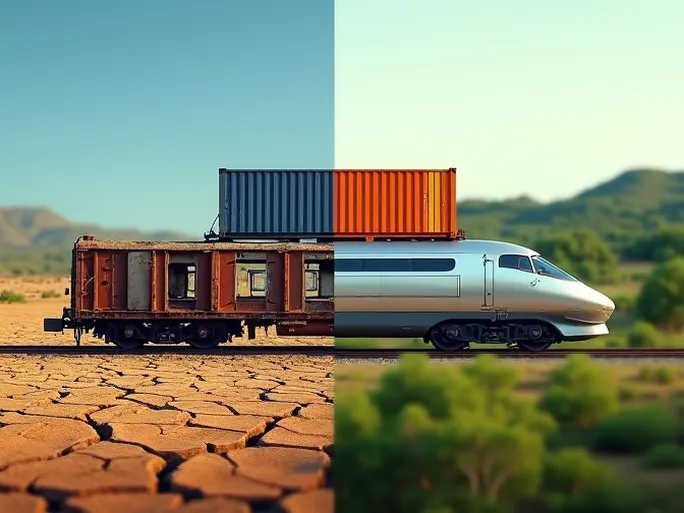

If the US economy were a speeding train, rail freight would serve as its crucial barometer. Recent data from the Association of American Railroads (AAR) paints a complex picture: while traditional carload traffic plummets, intermodal shipping demonstrates surprising resilience - what economic signals lie beneath these contrasting trends?

Carload Traffic: Signs of Economic Chill?

The week ending August 8 saw US rail carloads drop to 220,343 units, marking a 15.6% year-over-year decline . Though slightly improved from previous weeks (217,961 units on August 1 and 215,171 units on July 25), the downward trajectory remains unmistakable.

Analysis of AAR's ten major commodity categories reveals only grain shipments showed growth, adding 773 carloads to reach 22,081 units. All other categories declined significantly:

- Coal shipments plunged 18,113 carloads to 59,328 units

- Non-metallic minerals dropped 11,269 carloads to 30,706 units

- Metal ores and products decreased by 6,591 carloads to 15,754 units

The coal sector's dramatic contraction reflects America's energy transition, with renewable sources and environmental regulations steadily eroding demand. Declines in construction-related materials suggest weakening activity in manufacturing and infrastructure sectors, potentially signaling broader economic headwinds.

Intermodal Shipping: A Lone Bright Spot

In stark contrast, intermodal containers and trailers reached 277,054 units during the same period - a 1.9% year-over-year increase and improvement over prior weeks (270,277 units on August 1; 266,160 units on July 25). This growth stems from intermodal's cost efficiency for long-haul shipments and adaptability to evolving supply chain needs, particularly e-commerce's explosive expansion.

Year-to-Date Performance: Mixed Signals

Cumulative data for 2019's first 32 weeks shows:

- Total carloads: 6,770,373 units (

16.2% decline

)

- Intermodal units: 7,764,577 containers/trailers (

8.8% decline

)

While both metrics show negative trends, intermodal's relatively modest decrease demonstrates stronger market resilience compared to traditional rail freight.

Economic Implications and Strategic Pathways

This divergence mirrors structural shifts in the US economy - traditional industries recede while new consumption patterns and logistics innovations emerge. Intermodal's rise signals a transition toward more diversified, efficient economic models.

Global trade dynamics further complicate the picture, as geopolitical tensions and tariff disputes create additional volatility in freight volumes. Close monitoring of international trade developments remains essential for accurate forecasting.

For rail operators navigating this transformation, strategic priorities should include:

1.

Technology Adoption:

Implementing automation, AI-driven scheduling, and predictive maintenance to enhance efficiency

2.

Service Diversification:

Expanding into integrated logistics solutions including warehousing and last-mile delivery

3.

Sustainability Initiatives:

Transitioning to cleaner energy sources and low-emission operations

4.

Strategic Partnerships:

Collaborating with ports, trucking firms, and ocean carriers to create seamless multimodal networks

5.

Data Analytics:

Leveraging big data to optimize routing, resource allocation, and customer service

These measures could position rail freight as a continued driver of US economic competitiveness amid changing market conditions.