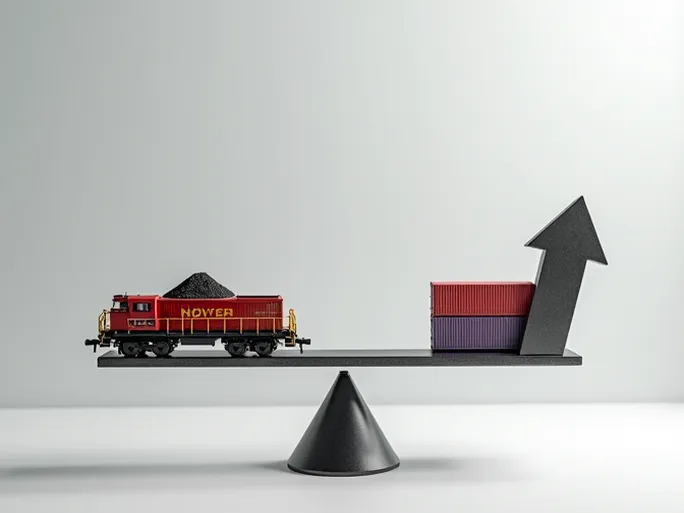

The latest data from the Association of American Railroads (AAR) reveals a nuanced picture of the U.S. rail freight market, with carload volumes showing modest growth while intermodal traffic faces downward pressure. The report for the week ending October 18 provides critical insights into the current state of rail transportation and its implications for economic activity.

Carload Traffic: Steady Growth with Slowing Momentum

U.S. railroads originated 224,244 carloads during the reported week, marking a 0.3% year-over-year increase. While maintaining positive growth, the pace has slowed compared to previous weeks (224,562 carloads in the week ending October 11 and 224,972 in the week ending October 4), suggesting weakening growth momentum despite stable overall demand.

Among the 10 major commodity categories tracked by AAR, five showed year-over-year increases:

- Nonmetallic minerals: The most significant gain at 3,253 carloads, reaching 33,517 total. This likely reflects ongoing construction sector recovery and infrastructure project development.

- Metallic ores and metals: Increased by 1,461 carloads to 20,355, potentially driven by global economic recovery boosting metal demand.

- Chemicals: Rose by 970 carloads to 32,046, indicating robust manufacturing activity as chemicals serve as essential industrial inputs.

However, several commodities experienced declines:

- Grain: Fell by 2,364 carloads to 21,011, potentially affected by weather conditions, crop yields, or international trade policies.

- Miscellaneous carloads: Dropped by 1,521 to 8,413, possibly indicating softness in certain economic sectors.

- Coal: Decreased by 1,057 carloads to 57,604, continuing a long-term trend influenced by environmental policies and renewable energy development.

Intermodal Traffic: Facing Significant Headwinds

In contrast to carload growth, intermodal units (containers and trailers) declined to 273,610, representing a 4.8% year-over-year decrease. This follows a downward trend from previous weeks (273,900 units in the week ending October 11 and 278,566 in the week ending October 4).

Potential contributing factors include:

- Persistent port congestion causing shipping delays

- Increased trucking capacity and lower freight rates diverting shipments from rail

- Shifting consumer demand patterns

Year-to-Date Performance: Overall Growth with Emerging Risks

Despite recent mixed results, cumulative data through the first 42 weeks of 2025 shows positive trends:

- Total U.S. rail carloads reached 9,326,053, up 2.0% year-over-year

- Intermodal volume totaled 11,399,777 units, a 3.2% increase

These figures suggest sustained economic expansion driving rail freight demand, though potential risks warrant monitoring:

- Global economic slowdown reducing freight demand

- Supply chain disruptions from geopolitical tensions or natural disasters

- Policy changes affecting trade or environmental regulations

Industry Adaptation to Market Conditions

AAR's latest Rail Industry Overview notes that rail freight volumes continue "adjusting to evolving market conditions." September data showed a 1.2% year-over-year carload decline across 12 of 20 commodities, though weekly averages (225,783 carloads) exceeded the year's prior weekly average (221,853).

Intermodal traffic similarly declined 1.3% in September, while weekly averages (275,559 units) surpassed year-to-date weekly averages (271,121). The association emphasizes the industry's need for flexibility in responding to market shifts.

Market Insights and Future Outlook

The data reveals several key economic insights:

- Commodity mix changes reflect structural economic shifts, such as infrastructure investment driving nonmetallic minerals demand

- Regional variations mirror local economic conditions and industrial specialization

- Competitive pressures from alternative transport modes require strategic responses

- Technological innovations in automation and digitalization present efficiency opportunities

Looking ahead, the rail freight market faces both opportunities from continued economic growth and infrastructure development, and challenges from competitive pressures and policy changes. Industry success will likely depend on:

- Operational efficiency improvements

- Enhanced customer service capabilities

- Diversification into logistics and intermodal services

- Strategic partnerships to address market challenges

The U.S. rail freight market remains a dynamic indicator of broader economic conditions. Careful analysis of these transportation metrics provides valuable insights for business decision-making amid evolving market circumstances.