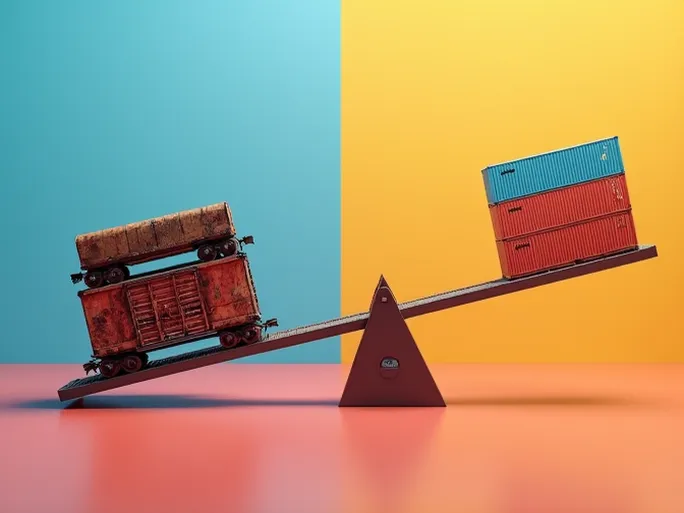

The rail freight industry stands at a crossroads, facing both significant challenges and unprecedented opportunities. Recent data reveals a complex picture of market transformation that demands strategic adaptation from industry stakeholders.

Diverging Market Trends

According to the latest figures from the Association of American Railroads (AAR), traditional rail carload traffic declined by 7.5% year-over-year for the week ending October 17, totaling 226,828 units. This downward trajectory reflects weakening demand in conventional rail freight sectors.

However, intermodal traffic tells a different story. During the same period, intermodal container and trailer volumes surged by 11.3% to 291,935 units, surpassing performance levels from previous weeks. This striking divergence highlights fundamental shifts in transportation preferences.

Carload Declines: Sector-Specific Impacts

The carload decrease reveals important sector variations. While coal shipments plummeted by 15,084 units and non-metallic minerals fell by 4,932 units, several categories demonstrated resilience:

- Grain shipments increased by 4,920 units to 25,547

- Miscellaneous carloads grew by 1,223 units

- Automotive and parts shipments rose by 884 units

These variations suggest opportunities for targeted service offerings and strategic portfolio adjustments within the rail industry.

Intermodal Emerges as Growth Engine

The robust performance of intermodal transport represents the most promising development in rail logistics. AAR President and CEO Ian Jefferies noted the sector's remarkable recovery from earlier pandemic-related declines, with September recording the third-highest weekly intermodal volume in history.

Automotive transport has shown particular strength as manufacturing activity rebounds. This resurgence demonstrates the sector's capacity for rapid adaptation to changing market conditions.

Key Drivers of Intermodal Growth

Several structural factors underpin intermodal's expansion:

- E-commerce expansion: Surging demand for consumer goods transportation

- Supply chain restructuring: Increased need for flexible, resilient logistics solutions

- Environmental considerations: Preference for lower-emission transport options

- Technological advancements: Improved tracking and operational efficiency through digital tools

Strategic Recommendations for Industry Adaptation

To capitalize on these market shifts, rail operators should consider several strategic initiatives:

- Enhance intermodal infrastructure investment

- Expand service offerings to include door-to-door solutions

- Strengthen partnerships with ports and trucking companies

- Leverage digital technologies for operational optimization

- Prioritize sustainability initiatives to meet evolving customer expectations

Year-to-date figures still show overall declines (14.9% for carloads and 5.1% for intermodal), but the positive intermodal trend suggests a viable path forward for rail freight's transformation.

The industry's ability to adapt to these market dynamics will determine its competitive position in the evolving logistics landscape. Strategic focus on high-growth segments combined with operational innovation presents the most promising route to long-term success.