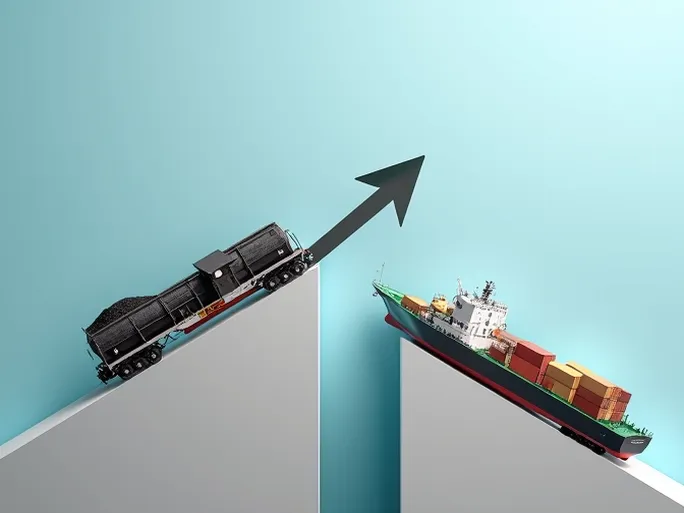

Recent industry data reveals a striking divergence in the U.S. rail freight sector during the week ending December 6. While carload volumes showed modest growth, intermodal traffic unexpectedly declined—a phenomenon that has prompted deep analysis of shifting transportation patterns.

Carload Gains Driven by Coal and Grain

According to the Association of American Railroads (AAR), total rail carloads reached 228,823 units during the measured week, marking a 1.7% year-over-year increase . This performance notably rebounded from the Thanksgiving-affected prior week (197,955 carloads) though remained slightly below the 234,592 carloads recorded two weeks earlier.

Five of the ten major commodity categories tracked by AAR posted annual gains, with particularly strong showings in:

• Coal:

61,026 carloads (+3,147 YoY)

• Grain:

25,098 carloads (+1,952 YoY)

• Nonmetallic minerals:

29,330 carloads (+1,161 YoY)

These figures reflect sustained domestic energy needs, robust agricultural production, and steady infrastructure development.

Intermodal Decline Signals Supply Chain Stress

In contrast, intermodal container and trailer volumes fell to 280,176 units—a 5.4% annual decline . Though improved from previous weeks' holiday-depressed levels, the persistent downward trend suggests ongoing supply chain constraints including port congestion, truck driver shortages, and container availability issues.

Annual Figures Maintain Positive Trajectory

Despite the weekly divergence, cumulative 2025 data through 49 weeks shows balanced growth:

• Total carloads:

10,889,132 (+1.8% YoY)

• Intermodal units:

13,227,231 (+1.8% YoY)

Expert Perspectives on Market Dynamics

Industry analysts offer competing interpretations of this bifurcation:

"Traditional energy demands continue supporting carload volumes," observed one transportation economist, "while intermodal struggles reflect global supply chain fractures—from port bottlenecks to equipment shortages."

Others suggest structural shifts in consumer behavior may be redirecting freight flows. The e-commerce boom increasingly favors direct-to-consumer road shipments, potentially eroding rail intermodal's competitive position. Some shippers appear to be prioritizing road transport for greater flexibility amid supply chain uncertainty.

Commodity-Specific Pressures Emerge

Detailed breakdowns reveal particular challenges in:

• Chemicals:

32,548 carloads (-1,054 YoY)

• Metallic ores:

19,706 carloads (-601 YoY)

These declines likely reflect softening industrial demand and international trade tensions affecting raw material flows.

Strategic Implications for Rail Operators

The diverging trends underscore the need for rail operators to pursue diversification—expanding into specialized segments like cold chain logistics while strengthening multimodal partnerships. Digital transformation initiatives targeting operational efficiency and customer responsiveness may prove equally critical as carriers navigate an evolving freight landscape.

As one industry strategist noted, "The railroads that thrive will be those that combine infrastructure investment with data-driven agility—adapting their networks to serve both traditional bulk commodities and emerging logistics needs."