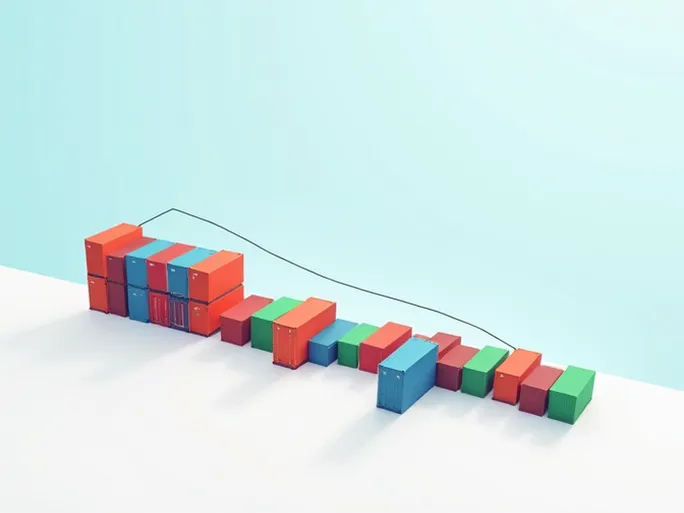

The silent highways and overflowing warehouses tell a story of economic uncertainty. Across America's vast road networks, truck traffic has noticeably thinned, while distribution centers struggle with mounting inventories. This stark contrast between idle capacity and stagnant goods movement paints a troubling picture of the nation's freight market in early 2023.

Part I: The Freight Payment Index - A Barometer of Economic Health

1.1 The Index's Significance

Launched in Q3 2017, the U.S. Bank Freight Payment Index has emerged as a crucial economic indicator, tracking both shipment volumes and expenditures across America's two primary freight modes: full truckload (TL) and less-than-truckload (LTL) services. The index's methodology incorporates seasonal adjustments and historical data dating to 2010, providing reliable comparisons across economic cycles.

1.2 Data Authority

With $46 billion in processed freight payments during 2022, U.S. Bank's direct transaction data offers unparalleled market visibility. This real-time financial data eliminates speculation, making the index particularly valuable for detecting early economic shifts.

Part II: Q1 Performance - Concerning Trends Emerge

2.1 Sustained Decline

The index registered 111.7 in Q1, marking a 0.8% quarterly and 6.1% annual decline - the fourth consecutive quarterly drop. This persistent downward trajectory suggests weakening industrial activity and softening consumer demand.

2.2 Regional Disparities

Market performance varied dramatically by geography:

Sharpest Declines: Southeast (-16.1%), West (-14.1%), and Northeast (-13.8%) regions suffered most, reflecting localized economic vulnerabilities.

Midwest Resilience: Though declining for 12 straight quarters, the industrial heartland's 2.4% drop showed relative stability.

Southwest Surge: A 14% annual increase - the strongest since early 2018 - likely tied to energy sector expansion amid elevated oil prices.

2.3 Spending Retreat

The freight expenditure index fell to 269.9, recording its first annual decrease since Q3 2020. A 13% diesel price drop contributed significantly, though reduced shipment volumes remained the primary driver.

Part III: Expert Analysis - Mixed Signals Ahead

3.1 ATA Chief Economist's Perspective

Bob Costello notes some positive developments amid the downturn:

Inventory Correction: Retail stock-to-sales ratios have nearly normalized to pre-pandemic levels, potentially enabling restocking demand later in 2023.

Capacity Reduction: Smaller fleets exiting the market and larger carriers operating fewer trucks may help stabilize rates.

3.2 Structural Challenges

Persistent headwinds include:

Housing Slowdown: Residential construction lethargy continues depressing related freight demand.

Manufacturing Weakness: The ISM Manufacturing PMI's prolonged contraction signals reduced industrial shipping needs.

Part IV: Regional Expenditure Patterns

Spending mirrored shipment trends:

Southwest Leadership: 16.7% annual growth outpaced all regions, while the Midwest's 8% decline reflected manufacturing struggles.

Part V: Outlook - Cautious Optimism

5.1 Near-Term Expectations

While downward pressure persists, moderating declines and capacity adjustments suggest potential stabilization. Inventory normalization could spur late-year demand.

5.2 Strategic Recommendations

Carriers should:

- Monitor leading indicators closely

- Optimize fleet utilization

- Target growth sectors like energy

Part VI: Supply Chain Implications

6.1 Proactive Measures

The index serves as an early warning system, prompting shippers to:

- Refine inventory strategies

- Diversify transportation modes

- Strengthen vendor collaboration

6.2 Building Resilience

Longer-term, businesses must enhance supply chain flexibility through:

- Multi-sourcing initiatives

- Contingency planning

- Comprehensive risk assessment

The freight sector's current challenges reflect broader economic transitions. While near-term pressures remain, strategic adaptation and operational discipline can position stakeholders for eventual recovery.