The U.S. trucking industry is experiencing a puzzling phenomenon that defies conventional economic wisdom. While freight demand has declined, shipping rates have unexpectedly increased, signaling potential structural issues in the market.

I. The DAT Freight Index: A Market Barometer

The DAT Freight & Analytics' Truckload Volume Index (TVI) serves as a crucial market indicator, tracking monthly freight volume changes with a baseline of 100 from January 2015. This standardized index covers three primary truck types:

- Dry vans

- Refrigerated trailers

- Flatbed trucks

II. September's Market Anomaly

Recent DAT data reveals contradictory trends:

- Dry vans: TVI dropped 3% monthly and 2% yearly to 234

- Refrigerated trailers: TVI fell 7% monthly but rose 2% yearly to 184

- Flatbed trucks: TVI increased 1% monthly and 9% yearly to 307

Despite these volume declines, spot market rates showed surprising increases:

- Dry vans: $2.05/mile (+$0.02)

- Refrigerated: $2.44/mile (+$0.03)

- Flatbeds: $2.50/mile (+$0.01)

III. Warning Signs in Price Increases

DAT Chief Analyst Ken Adamo cautions that these rate hikes reflect market imbalances rather than genuine demand growth:

"When rates rise without corresponding volume increases, it's like inflation without wage growth - problematic for the industry," Adamo explained. "Freight brokers face particular challenges as their profit margins compress without sufficient volume to compensate."

IV. Carrier Challenges and Opportunities

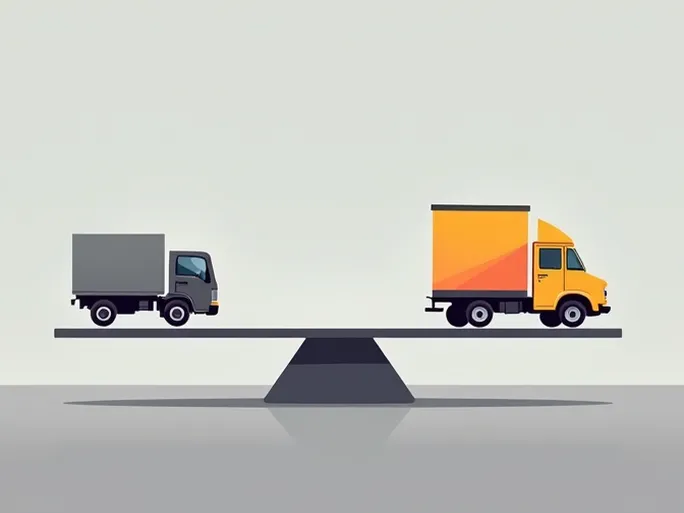

The situation presents mixed outcomes for carriers:

- Smaller carriers (5-10 trucks) may benefit from 20% rate increases on backhaul routes

- Industry continues to see carrier attrition, with approximately 1,200 interstate carriers exiting in September

- Market conditions remain precarious despite temporary rate improvements

V. Regional Imbalances vs. Systemic Growth

Adamo notes the current environment shows selective route increases rather than broad market growth:

"When you see some lanes rising while others fall, it indicates regional imbalances rather than systemic market strength. We're not seeing the macroeconomic pressures that would drive widespread growth."

VI. Bleak Peak Season Outlook

Industry expectations for the traditional Q4 peak season remain pessimistic:

- Port volumes declined in September after August's strong performance

- Potential for continued carrier attrition through year-end

- Market may require further adjustment before finding equilibrium

VII. Macroeconomic Pressures

The trucking industry faces broader economic challenges:

- Persistent inflation concerns

- Potential Federal Reserve rate hikes increasing operational costs

- Geopolitical risks affecting fuel prices and supply chains

VIII. Driver Challenges

Truck drivers bear the brunt of these market conditions:

- Extended work hours and fatigue risks

- Income volatility tied to market fluctuations

- Difficult living conditions on the road

IX. Industry Transformation

Potential adaptations for the sector include:

- Adoption of autonomous and electric vehicle technologies

- Innovative logistics models like shared trucking

- Policy support for infrastructure and operations

As the industry navigates these complex challenges, market participants must remain vigilant to emerging trends and prepare for potential difficulties ahead.