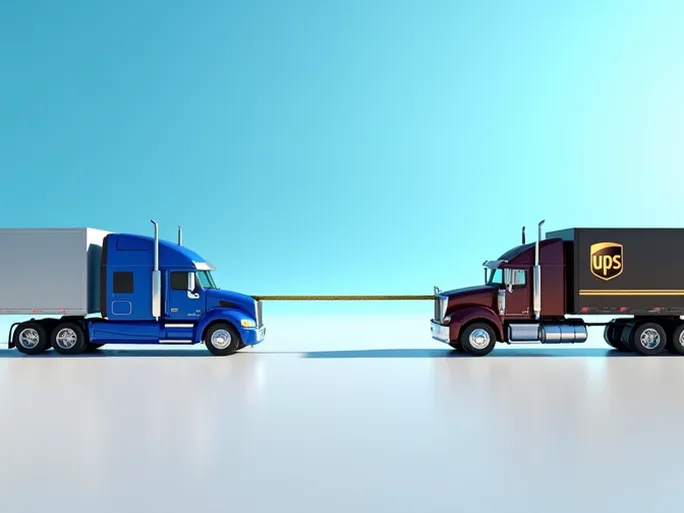

The transaction marks a strategic retreat for UPS from truck brokerage while positioning RXO as the industry's third-largest player

In the rapidly evolving logistics sector, corporate strategy shifts and mergers resemble calculated chess moves that reshape market dynamics. The recent announcement that United Parcel Service (UPS) plans to sell its truck brokerage division Coyote Logistics to RXO Logistics represents a significant industry development. The $1.025 billion deal not only elevates RXO to become North America's third-largest freight broker but also reflects UPS's strategic reassessment of its core business priorities.

Transaction Overview

Under the agreement, RXO Logistics will acquire Coyote Logistics for $1.025 billion, with completion expected by year-end pending regulatory approvals. UPS CEO Carol B. Tomé stated the divestiture allows UPS to sharpen its focus on being the world's premier small package delivery provider and logistics partner.

UPS first signaled its exploration of strategic alternatives for Coyote during its Q4 2023 earnings call. The company originally acquired Coyote in July 2015 for $1.8 billion, viewing the purchase as critical for entering the competitive truck brokerage market through an established, fast-growing firm.

Coyote Logistics: A Growth Story

Founded in 2006, Coyote Logistics generated $2.1 billion in annual revenue by 2014 prior to its UPS acquisition. The company expanded significantly through strategic moves, including its March 2014 merger with Access America Transport, which subsequently operated under the Coyote brand. Coyote's business model centered on using technology platforms to efficiently connect shippers with carriers.

RXO's Strategic Rationale

RXO leadership positions the acquisition as transformational, immediately establishing the company as a scaled industry leader. The combination will expand RXO's market presence, offering customers greater capacity options while providing carriers increased freight opportunities.

"This acquisition rapidly scales our brokerage business and enhances our service offerings," said RXO CEO Drew Wilkerson. "We anticipate significant synergies through integration of Coyote's advanced technology and complementary client base."

The transaction brings RXO approximately 15,000 new customers and 97,000 carrier partners from Coyote, with minimal client overlap between the two organizations. RXO currently serves about 4,000 customers and works with 115,000 carriers.

UPS's Strategic Retreat

During recent earnings discussions, CEO Tomé acknowledged UPS may have underestimated the cyclical nature of truck brokerage when acquiring Coyote. While Coyote's revenue peaked above $4 billion during the pandemic, it subsequently declined sharply - contributing to 38% of UPS's full-year revenue decline in its supply chain solutions segment.

"The volatility proved incompatible with our operating model," Tomé explained. "We determined this business holds greater value for other operators better positioned to manage its cyclicality."

Industry Perspectives

Industry analysts view RXO as a natural acquirer for Coyote. Evan Armstrong of Armstrong & Associates noted the purchase price represents an attractive 11.9x EBITDA multiple during a market trough. The deal positions RXO as the third-largest domestic transportation management provider, trailing only C.H. Robinson and J.B. Hunt.

"Cultural misalignment became apparent as key Coyote executives departed UPS," Armstrong observed. "UPS ultimately recognized the challenges of competing in this fragmented market and chose to refocus on its core parcel delivery business."

Market Implications

The transaction signals broader industry trends as logistics providers reassess their portfolios amid economic uncertainty. For RXO, the acquisition delivers immediate scale and market position. For UPS, the divestiture represents strategic prioritization of higher-margin core operations.

As digital transformation reshapes logistics, companies must balance growth aspirations with operational realities. This deal highlights how strategic acquisitions require cultural compatibility and operational alignment to deliver long-term value - lessons that will resonate across the evolving transportation sector.