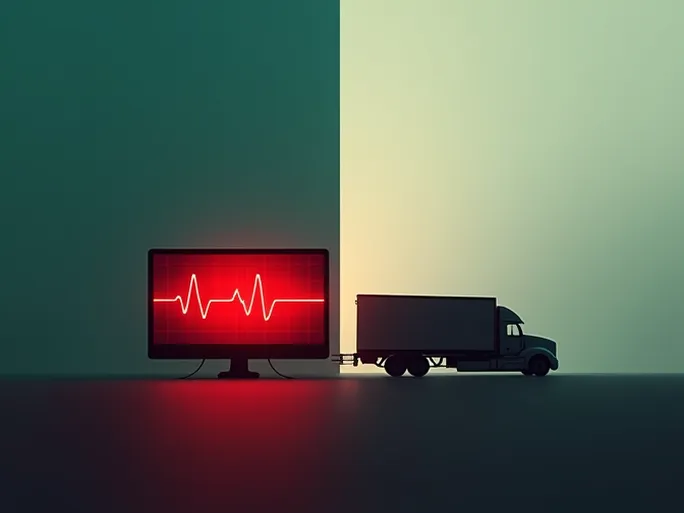

If stock markets serve as the barometer of economic health, then the freight market undoubtedly represents the pulse of the real economy. When this pulse beats irregularly, what does it portend? Lee Klaskow, senior global transportation and logistics analyst at Bloomberg Intelligence, recently provided a thorough analysis of the critical issues facing the U.S. economy and freight market during a webinar hosted by Tucker Worldwide, America's oldest freight brokerage firm headquartered in Haddonfield, New Jersey.

Assessing Recession Risks

Klaskow revealed that according to Bloomberg's predictive models, the probability of a U.S. economic recession stands at a concerning 65%. He suggested that even if a recession materializes, it would likely be relatively shallow and short-lived, based on comprehensive evaluations of current economic structures and potential recovery drivers. However, the outlook appears more severe for the freight market. Klaskow unequivocally stated that the freight sector is already experiencing a recession, primarily driven by declining shipment volumes, elevated inventory levels, and challenging year-over-year comparisons.

Current Freight Market Conditions

The analyst emphasized that current freight volumes aren't objectively "poor" but rather represent a decline from last year's peak levels. This relative decrease, combined with inventory glut, has significantly depressed freight prices. In the trucking sector specifically, spot prices have fallen approximately 20%. Nevertheless, Klaskow believes spot prices may be nearing their floor, with limited potential for further substantial drops, primarily because market capacity is gradually contracting.

Capacity Reduction and Market Rebalancing

Citing data from Derek Leathers, Chairman, President and CEO of Werner Enterprises during the company's Q1 earnings call, Klaskow noted that current spot market prices sit about 13-17% below independent operators' breakeven costs. This unsustainable situation will accelerate capacity exits from the market. Paradoxically, this capacity reduction could help rebalance supply-demand dynamics. Seasonal demand strengthening—particularly during beverage season and subsequent holiday peaks—should bolster trucking demand, maintaining sector resilience even during a mild recession.

Second Half Outlook and Corporate Strategies

Klaskow anticipates improving trucking market conditions in the latter half of 2023, primarily driven by spot price stabilization that should support contract rates. While contract prices may not surge dramatically, moderate increases could offset carriers' inflationary pressures from rising labor, insurance, and maintenance costs. He particularly highlighted how large publicly-traded companies with robust capital positions and strong balance sheets are better equipped to navigate current challenges. These firms have actively diversified into less volatile segments—such as freight brokerage or, like Knight-Swift, into less-than-truckload (LTL) operations—which typically demonstrate less cyclicality than full truckload markets.

Market Normalization and Long-Term Perspective

Tucker referenced Morgan Stanley data showing current market conditions align with 10-year industry averages despite pandemic distortions. Klaskow concurred, noting that trucking companies and logistics providers enjoyed "peak profitability" during 2021-2022, though many will require extended periods to return to those levels. He characterized that period as a "once-in-a-lifetime" environment that presented extraordinary opportunities for operators. Importantly, spot prices remain above 2018-2019 levels, indicating the market isn't fundamentally "bad." The core issue stems from excessive capacity additions by marginally profitable operators. For truckers, profitability constitutes the essential operating motive—prolonged reliance on cash flow to cover leases or loans inevitably forces capacity exits.

Peak Season Projections

When asked about 2023 peak season prospects, Klaskow predicted this year's period would appear "more normal" than 2022's. While not anticipating dramatic demand surges, he expects gradual demand improvement, largely because retailers have spent the past year successfully reducing inventories. Current inventory levels show improvement though haven't reached ideal targets, suggesting continued progress toward normalization.

Inventory Adjustment and Supply Chain Optimization

The analyst projected inventory levels could return to more normal ranges during late 2023. He reminded audiences that bloated inventories resulted not from excessive consumer spending but rather from companies over-purchasing goods during supply chain disruptions. When shelves emptied due to logistical bottlenecks, consumers rapidly purchased available merchandise. However, when demand abruptly slowed, businesses found themselves overstocked, requiring gradual inventory digestion.

Strategic Implications: Navigating Freight Markets During Economic Downturns

Klaskow's analysis provides valuable insights for freight companies, logistics providers, and broader commercial sectors. Key strategic considerations include:

1. Acknowledge recession risks and implement proactive mitigation measures rather than relying on optimistic assumptions.

2. Monitor capacity trends closely to identify emerging opportunities as market conditions evolve.

3. Pursue business diversification to reduce exposure to cyclical market segments.

4. Enhance inventory management and supply chain efficiency to avoid overstocking.

5. Leverage technological innovations to improve operational efficiency and service quality.

6. Invest in workforce development to enhance organizational capabilities.

7. Strengthen collaborative partnerships to achieve mutual benefits during challenging periods.

8. Track regulatory developments that may influence operational requirements.

9. Implement precision operations to maximize cost efficiency.

10. Maintain operational flexibility to adapt to dynamic market conditions.

Klaskow's comprehensive examination offers crucial perspective on freight market challenges and opportunities. By recognizing realities, responding strategically, diversifying operations, optimizing management, embracing innovation, and fostering collaboration, companies can successfully weather economic downturns while positioning for sustainable growth. As an economic bellwether, freight market trends warrant continued close observation and analysis.