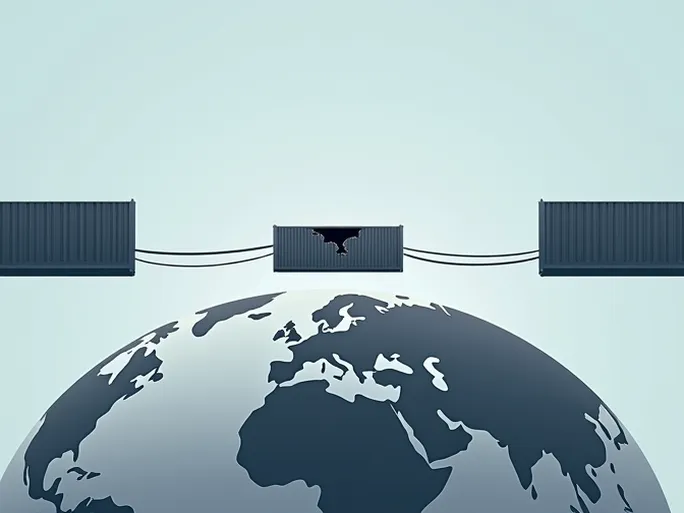

The global economy operates like a precision timepiece, with countless gears, screws, and springs working in perfect harmony to maintain accurate timekeeping. The global supply chain serves as this clock's core transmission system, where each component is critical and interconnected. Intermodal transport, as the crucial link connecting sea, land, and air networks across global trade arteries, represents one of the system's most vital gears.

However, in early 2020, the sudden emergence of COVID-19 acted like a massive wrench jamming this delicate mechanism, subjecting intermodal transport to unprecedented challenges. The once-smoothly turning gears began emitting jarring friction noises, with some components grinding to a complete halt.

The latest quarterly report from the Intermodal Association of North America (IANA) sounded an alarm for the industry. Data revealed a 6.7% year-over-year decline in total intermodal volume during Q1—not an insignificant figure, but one representing global trade contraction and severe supply chain challenges. More importantly, it foreshadowed additional obstacles and uncertainties ahead.

Q1 Data: Structural Divergence Amid "Fire and Ice" Conditions

IANA's report detailed 4,177,989 intermodal units moved during Q1, revealing a "fire and ice" dichotomy within the sector.

Domestic container transport emerged as the sole bright spot, achieving 2.2% growth to reach 1,862,499 units—a small flame of hope in an otherwise frigid landscape. This growth stemmed from several factors:

- Resilient U.S. consumer demand: Despite economic shocks, essential purchases of household goods maintained domestic freight volumes.

- Modal shift from truck to rail: Rising trucking costs and driver shortages prompted increased rail utilization.

- E-commerce expansion: Pandemic-driven online shopping boosted parcel shipments, with rail gaining long-haul e-commerce freight.

Other segments fared dramatically worse:

Trailer transport plummeted 22.3% to just 257,805 units, reflecting:

- Intensified trucking market competition across full truckload (TL), less-than-truckload (LTL), parcel, and temperature-controlled segments

- Ongoing containerization replacing trailer equipment

- Heightened sensitivity to fuel price volatility

ISO containers declined 11.3% to 2,057,685 units due to:

- Global trade contraction from pandemic restrictions

- Extended Chinese factory shutdowns post-Lunar New Year

- International shipping disruptions including port congestion

Total domestic equipment (containers and trailers) fell 1.8% to 2,120,304 units, though performing slightly better than Q4 2019's 7.4% decline—a potential indicator of market adaptation.

Pandemic Shockwaves: A "Perfect Storm" of Disruptions

IANA identified COVID-19 as the primary Q1 disruptor, creating a "perfect storm" through multiple channels:

- Manufacturing paralysis: North American auto plants and factories shuttered, slashing demand for components and materials.

- Import collapse: Global trade contraction—particularly from China—created supply chain bottlenecks.

- Extended Lunar New Year effects: Traditional seasonal slowdowns compounded by prolonged pandemic shutdowns.

Trailer Transport's Structural Crisis: Accelerated Decline

IANA President Joni Casey noted trailers faced pre-existing challenges that the pandemic accelerated. Key pressures include:

- Container substitution: Superior security, efficiency and modal flexibility drive container adoption.

- Trucking competition: Market fragmentation across TL, LTL, parcel and reefer segments erodes trailer share.

Outlook: Navigating Uncertainty

IANA projects continued Q2 declines potentially exceeding Q1, with possible domestic recovery in Q3 as U.S. consumption rebounds. International volumes may languish through 2020 amid global economic weakness. The association forecasts potential 15-20% domestic container declines from soft demand, low fuel prices and reduced imports.

IANA estimates full-year intermodal volume could fall approximately 15%, though extreme uncertainty clouds projections. Industry participants must maintain vigilance, monitoring market shifts and adapting operational strategies to survive challenging conditions.

Strategic recommendations include:

- Tracking pandemic developments and policy responses

- Enhancing risk management frameworks

- Optimizing operational efficiency

- Exploring e-commerce and cold chain opportunities

- Strengthening industry partnerships

The intermodal sector faces formidable challenges but retains long-term potential for operators demonstrating adaptability, innovation and collaborative approaches.