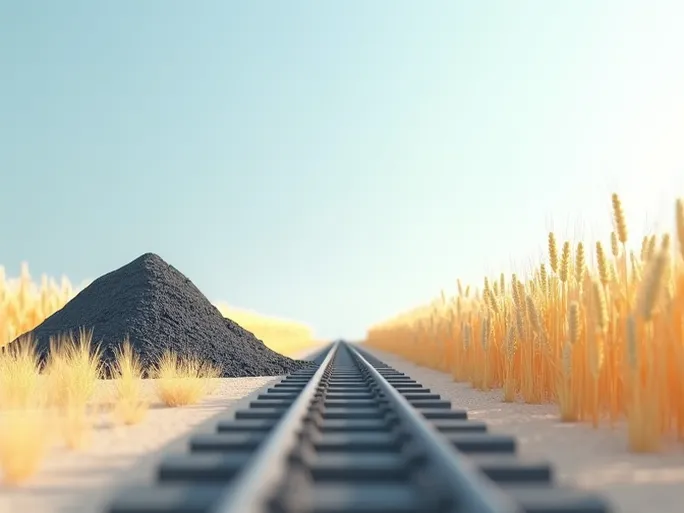

As the pulse of the global economy beats to the rhythm of railway operations, a concerning trend emerges: U.S. rail freight volume experienced an annual decline during the third week of September. Data released by the Association of American Railroads (AAR) shows both freight carloads and intermodal units decreased year-over-year, casting shadows over global economic recovery prospects. Yet amidst this downturn, a silver lining appears—significant growth in grain shipments suggests resilience in the agricultural sector.

Overall Freight Volume Under Pressure, Coal Shipments Lead Decline

The AAR reported 228,609 carloads for the week ending September 20, marking a 1.8% decrease compared to the same period last year. This figure sits slightly below the 231,237 carloads recorded the previous week (ending September 13), but remains higher than the 214,383 carloads from two weeks prior (ending September 6). Among the 10 commodity categories tracked by AAR, only two showed annual growth while the rest declined.

Coal shipments suffered the most significant drop, falling by 3,112 carloads to 60,029—a decline reflecting ongoing energy sector transitions and growing reliance on renewable sources. Miscellaneous freight (down 1,644 carloads to 8,634) and nonmetallic minerals (down 736 carloads to 31,402) also contributed to the overall downturn.

Grains and Metallic Ores Emerge as Growth Drivers

Despite the broader decline, grain and metallic ore shipments bucked the trend. Grain transport increased by 2,170 carloads to reach 23,147, demonstrating agricultural sector vitality. Metallic ores and metals also grew by 380 carloads to 20,358, indicating sustained industrial production demand.

Intermodal Volume Shows Modest Decline

Intermodal container and trailer traffic similarly decreased, with weekly volume reaching 282,068 units—a 2.5% annual decline . This figure sits marginally below the 282,930 units recorded the previous week but remains above the 253,497 units from two weeks prior. Analysts attribute the intermodal softening to multiple factors including port congestion, trucking competition, and shifting consumer demand patterns.

Year-to-Date Figures Maintain Positive Trajectory

The weekly declines contrast with cumulative annual data showing continued growth. Through the first 38 weeks of 2025, U.S. railroads moved 8,423,372 carloads ( up 2.2% ) and 10,289,962 intermodal units ( up 3.6% ), suggesting the recent downturn may represent temporary volatility rather than a reversal of long-term expansion.

Economic Implications of Rail Traffic Trends

Rail freight volumes serve as a key economic indicator, with declines often preceding slowdowns and increases signaling expansion. Industry analysts note the recent softening may reflect global trade tensions, manufacturing deceleration, consumer spending shifts, and weather disruptions—all factors requiring close monitoring.

Future Outlook: Balancing Challenges and Opportunities

The rail sector faces mounting pressures from energy transitions, trucking competition, and infrastructure investment needs. However, demographic growth, urbanization trends, and rail's environmental advantages present counterbalancing opportunities. Strategic innovation and operational upgrades could position railroads to maintain their critical role in America's economic ecosystem.