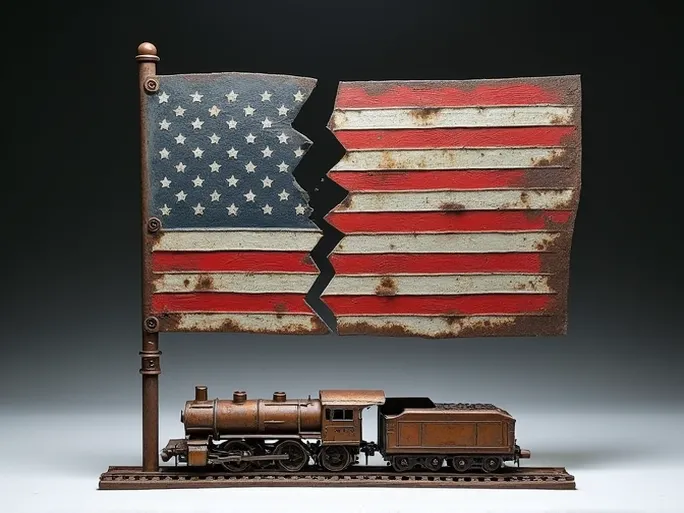

From the smartphone in your hand to the clothes on your back and the chair supporting you, nearly every manufactured product owes its existence to the chemical industry. This invisible giant quietly underpins one-quarter of U.S. GDP. Yet a potential seismic shift in the railroad sector now threatens the lifeblood of this critical industry.

Merger Concerns: Service Decline Under Monopoly Shadows

When Union Pacific (UP) and Norfolk Southern (NS) first floated merger plans in July, the American Chemistry Council (ACC) sounded immediate alarms. ACC CEO Chris Jahn warned that unless the deal demonstrably improves rail competition and service quality, his organization would urge the Surface Transportation Board (STB) to block the proposal.

"The STB must rigorously apply its new merger rules—rules written with the painful lessons of past rail consolidation," Jahn emphasized.

Over four decades, U.S. railroads have shrunk from 23 major carriers to just six, with four controlling 90% of freight traffic. Each merger brought deteriorating service. Today, 75% of ACC members face captive shipper status—with rail rates soaring 240% over 15 years for these constrained customers, compared to just 24% for those with competitive options.

Fragile Network: Calm Before the Storm?

While STB metrics show adequate current rail performance, Jahn attributes this to reduced freight volumes rather than improved service. "Freight railroads stand alone as America's only industry not pursuing growth," he noted pointedly.

The system's fragility became evident during pandemic disruptions when UP struggled with volume surges. By the mid-2030s, chemical industry growth may require 100,000 additional railcars—capacity the rail industry can't currently provide.

CPKC Merger: A Cautionary Tale

When asked how the UP-NS proposal differs from the recent CP-KCS merger, Jahn highlighted scale: "This would create a transcontinental behemoth controlling nearly half of U.S. rail freight." He cited CPKC CEO Keith Creel's own warning that such consolidation risks catastrophic service failures across supply chains.

Rate Pressures: Breaking Point for Manufacturers?

Rail pricing remains a top concern. One chemical CEO told Jahn that U.S. transportation costs create global competitive disadvantages. Though America ranks as the world's second-largest chemical producer (one-fourth China's output), uncompetitive rail networks contribute significantly to this gap.

Beyond base rates, railroads levy fuel surcharges, demurrage fees, and empty car charges—extracting nearly $3 billion in storage fees alone during 2021. "Railroads can dictate terms because they hold monopolies," Jahn explained. "Their attitude is 'This is the price—take it or leave it.'"

While rail remains the safest chemical transport method (one railcar replaces four trucks), profit-driven service cuts create operational challenges. Rail employment has plummeted 30% (45,000 jobs) with corresponding service declines.

ACC's Counteroffensive

The council has launched an advocacy campaign targeting legislators, White House officials, and the public about the merger's risks. "This fight centers on Main Street, not Wall Street," Jahn stressed, noting financial interests drive consolidation. Approval could trigger domino mergers, potentially leaving just two rail giants.

Regulatory Gaps: Who Guards Competition?

Jahn expressed concern over former STB member Robert Primus's dismissal, calling him "a champion for robust freight networks." He urged swift replacement with officials committed to STB's mission of ensuring fair, reliable rail service.

Reform Pathways: Lessons from Canada

Jahn called STB's April 2024 reciprocal switching rules a "missed opportunity." He advocates adopting Canada's successful model: "Their reciprocal switching system works flawlessly—enhancing competition without service disruptions."

The ACC continues battling to preserve America's manufacturing foundation, urging regulators and policymakers to confront rail monopolization risks before they undermine the nation's economic backbone.