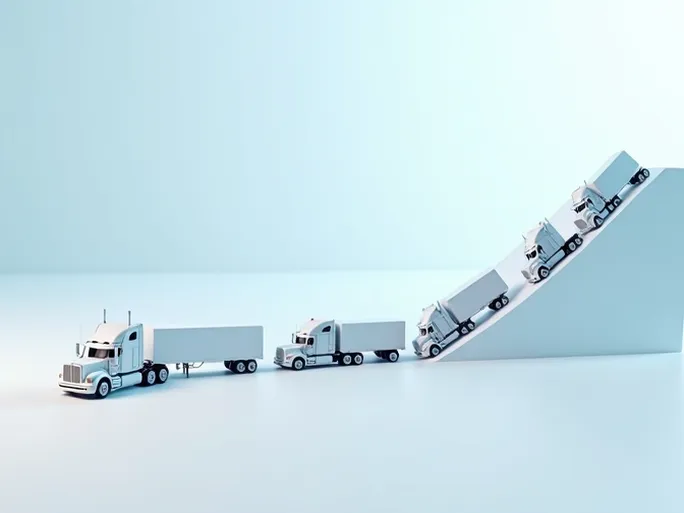

As truck drivers prepared for the usual summer shipping peak, the freight market appears to have entered an unexpected slowdown. According to the latest data from DAT Freight & Analytics, the week of July 21-27 saw weakening demand in the U.S. spot truckload market, with ample capacity pushing rates downward. What's driving this trend, and what does it signal for the coming months?

Market Overview: Declining Demand Outpaces Capacity Reduction

Data from DAT One shows freight volumes declined for the second consecutive week, dropping 3% week-over-week to 1.83 million loads, representing a 7% year-over-year decrease. Meanwhile, available trucks fell 6% to 324,253. This indicates that while capacity contracted, demand fell even faster, exacerbating the oversupply situation.

Segment Analysis: Across-the-Board Declines

A closer look reveals uniform weakness across all major trucking segments:

- Dry Vans: Loads fell 1.9% to 863,599 while truck posts dropped 6.2%. The load-to-truck ratio edged up to 4.1 from 4.0, but linehaul rates (excluding fuel surcharges) still declined to $1.64/mile.

- Reefers: Volumes dropped 3.8% to 409,340 loads with a 7.5% decrease in available trucks. Despite a higher 6.4 load-to-truck ratio, reefer rates fell $0.04 to $1.96/mile, likely due to weak agricultural shipments.

- Flatbeds: Showing the steepest decline at 5.6% to 559,343 loads, flatbeds saw their load-to-truck ratio drop to 11.9 as rates fell to $2.00/mile, indicating particularly acute oversupply.

DAT Chief Analyst Dean Croke notes the current dry van load-to-truck ratio of 4.1 is the highest for this calendar week in eight years, surpassed only by 2020's pandemic-driven 4.2. This suggests capacity remains relatively abundant despite softening demand.

Key Market Drivers

Several factors are contributing to the current market conditions:

- Slowing consumer spending amid persistent inflation

- Retail inventory adjustments reducing freight needs

- Persistent overcapacity from new truck entrants in recent years

- Volatile fuel prices impacting operating costs

- Exceptionally weak agricultural shipments (the lowest in a decade for this period)

Market Outlook

The freight market will likely continue facing downward pressure in the near term. While the approaching holiday season may stimulate demand, broader economic conditions and consumer behavior will ultimately determine the market's trajectory.

For shippers, the current oversupply presents negotiation opportunities. Carriers should focus on operational efficiency and targeting higher-margin segments to offset rate declines. Industry observers should monitor macroeconomic indicators for signs of market inflection.

The July slowdown marks an atypical departure from seasonal norms, with all segments experiencing rate erosion despite varying degrees of capacity adjustment. How long this trend persists will depend on how quickly the market can absorb excess capacity and whether fundamental demand drivers regain momentum.