As e-commerce booms and supply chains evolve, logistics properties face unprecedented demand while major acquisitions reshape the sector.

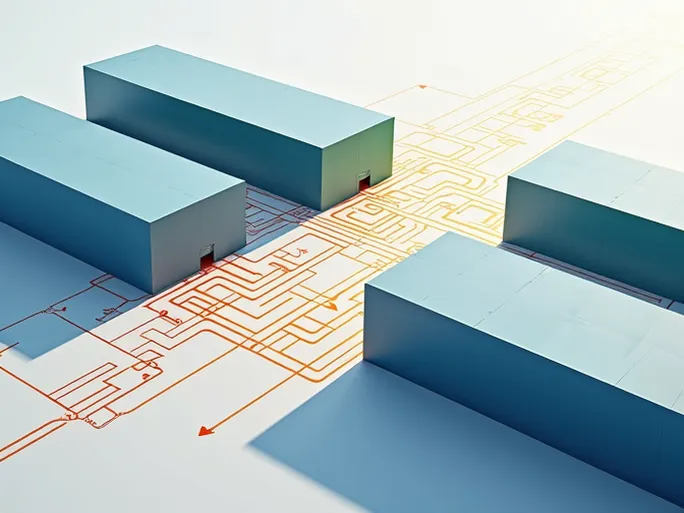

Imagine a massive logistics hub: trucks moving in constant flow, robots operating with precision, packages being sorted at lightning speed before reaching consumers. Yet behind this efficiency lies an increasingly scarce resource—industrial real estate. The U.S. logistics property market is undergoing transformative changes, with historic supply-demand imbalances and potential blockbuster mergers reshaping the industry.

Prologis Eyes Duke Realty in Sector Consolidation Push

Logistics real estate giant Prologis has expressed strong interest in acquiring Duke Realty Corporation, an Indianapolis-based REIT specializing in sustainable industrial properties. As the largest pure-play logistics REIT in the U.S., Duke Realty represents a strategic prize. A successful acquisition would cement Prologis' global leadership position while potentially triggering further industry consolidation. This move reflects intensifying competition for premium logistics assets and strategic positioning for future supply chain evolution.

Vacancy Rates Hit Record Lows

CBRE's U.S. Industrial Availability Index reveals industrial vacancy rates dropped by 10 basis points to 7.2% in Q2—the lowest level since 2000. Remarkably, this marks the 32nd consecutive quarter of declining vacancies, the longest such streak since records began in 1988. This sustained tightening signals profound market imbalance, with demand consistently outpacing supply and creating upward pressure on rental rates.

Multiple Drivers Fuel Demand

Several interconnected factors propel this demand surge. E-commerce growth remains the primary engine, requiring expanded warehouse and distribution networks to handle soaring online orders. Simultaneously, supply chain restructuring drives companies to increase inventories and geographically diversify fulfillment centers for greater resilience. Additional momentum comes from manufacturing reshoring and emerging industries requiring specialized industrial space.

Ports Demonstrate Adaptability

Despite 2025 policy changes, route adjustments, and unpredictable demand reshaping import patterns, U.S. ports have maintained operational fluidity through infrastructure investments, data-driven management, and inland network advantages. This underscores how robust infrastructure, digital transformation, and integrated transportation systems remain critical for supply chain stability amidst evolving trade dynamics.

Outlook: Growth Amid Constraints

The industrial real estate sector faces both significant opportunities and challenges. While e-commerce expansion, supply chain evolution, and new industrial sectors will sustain demand, constraints including land scarcity, rising construction costs, interest rate volatility, and stricter sustainability regulations may pressure market growth. Companies must balance strategic expansion with operational flexibility to navigate this complex environment.

Analyst Perspectives

Industry observers widely agree the current supply-demand imbalance will persist. As e-commerce penetration deepens and supply chains continue reorganizing, competition for quality logistics space will intensify. However, limited land availability and elevated development costs may drive sustained rental growth, potentially impacting corporate operating expenses. Solutions could include optimizing existing facilities, adopting automation technologies, and exploring cost-effective secondary markets.

The proposed Prologis-Duke Realty merger and record-low vacancy rates collectively illustrate the logistics property sector's pivotal moment. Market participants must remain agile to capitalize on emerging opportunities while addressing structural challenges in this increasingly vital component of modern commerce.