Imagine you're a logistics manager closely monitoring the pulse of the American economy. Rail freight, often considered an economic barometer, shows subtle changes that may forecast future trends. What signals are emerging from the latest data?

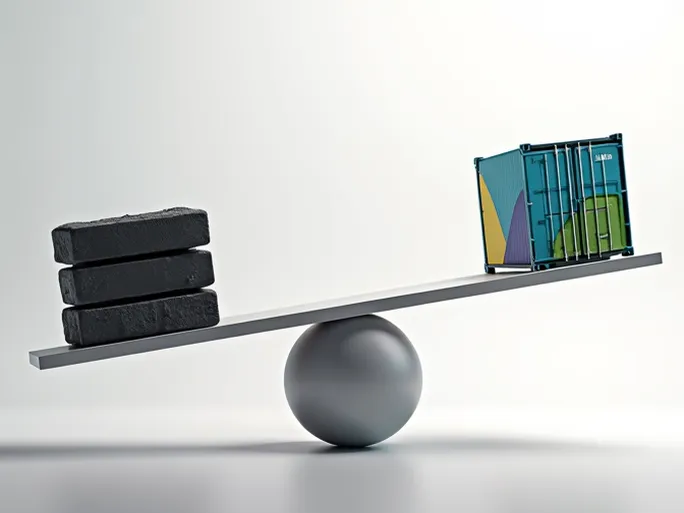

The Association of American Railroads (AAR) recently released data revealing a complex picture for the week ending February 8: while carload volumes experienced a slight decline, intermodal traffic demonstrated robust growth. This divergence raises important questions about economic health and supply chain implications.

Carload Traffic: Structural Bright Spots Amid Modest Decline

Weekly carload traffic reached 218,393 units, marking a 0.7% year-over-year decrease. Beneath this modest decline lies notable sectoral variation—eight of the ten commodity categories tracked by AAR showed annual growth, suggesting shifting demand patterns.

The chemicals sector stood out with an increase of 1,274 carloads to 34,390 total. Nonmetallic minerals also performed well, gaining 1,271 carloads to reach 27,904. Miscellaneous freight added 855 carloads, totaling 9,003. These gains reflect sector-specific vitality.

However, coal shipments plummeted by 4,722 carloads to 56,636, while metal ores and products declined by 1,523 to 16,917. Coal's downturn likely mirrors energy transition trends and growing renewable adoption, while metals may reflect global economic conditions and industrial demand shifts.

Intermodal Boom: A Standout Performer

In stark contrast, intermodal containers and trailers surged 7.4% annually to 284,056 units. This robust growth signals railroads' growing competitiveness in long-haul transportation, potentially driven by rising fuel costs, truck driver shortages, and environmental considerations.

Intermodal's strength lies in its flexible, efficient combination of rail and truck transport, enabling door-to-door service while reducing costs and emissions. As e-commerce expands and supply chains grow more complex, intermodal's potential appears significant.

Year-to-Date Trends: Structural Shifts Emerge

Cumulative 2024 data through February 8 reveals clearer patterns: total carloads reached 1,244,057, essentially flat year-over-year, while intermodal volume grew 9.7% to 1,613,771 units. This suggests intermodal is becoming the primary growth engine for rail freight, reflecting broader economic and logistical transformations.

Economic and Sectoral Influences

Multiple factors shape rail freight volumes, including macroeconomic conditions, industry trends, and regulatory policies. Current challenges—inflation, rising interest rates, and global uncertainty—all influence transportation demand.

Sector-specific developments also matter. Energy transitions affect coal shipments, while e-commerce growth fuels intermodal demand. Accurate forecasting requires synthesizing these diverse elements.

Future Outlook: Balancing Opportunities and Challenges

The rail freight sector faces both promise and obstacles. Economic expansion and supply chain complexity will sustain demand, while infrastructure investments and environmental policies may create new opportunities.

However, competition from trucking, infrastructure modernization needs, labor shortages, and technological changes present ongoing challenges. Rail operators must innovate to maintain competitiveness.

Supply Chain Implications: Adapting to Change

These trends offer crucial lessons for supply chain managers. Monitoring market dynamics enables strategic adjustments—reducing coal transport reliance while expanding intermodal utilization, for example.

Enhanced collaboration between supply chain professionals and railroads, through data sharing and coordinated planning, could optimize efficiency and responsiveness.

Ultimately, the U.S. rail freight market is undergoing significant transformation. The divergence between carload and intermodal performance reflects broader economic and logistical evolution. For supply chain leaders, staying informed and adaptable will be key to maintaining competitive advantage.