Imagine being a logistics manager anxiously monitoring computer screens as charts and data flash before your eyes. Rail freight, that vast and complex transportation network, serves as the lifeline of your operations. Every fluctuation directly impacts costs, efficiency, and customer satisfaction. So what insights do the latest rail freight figures reveal?

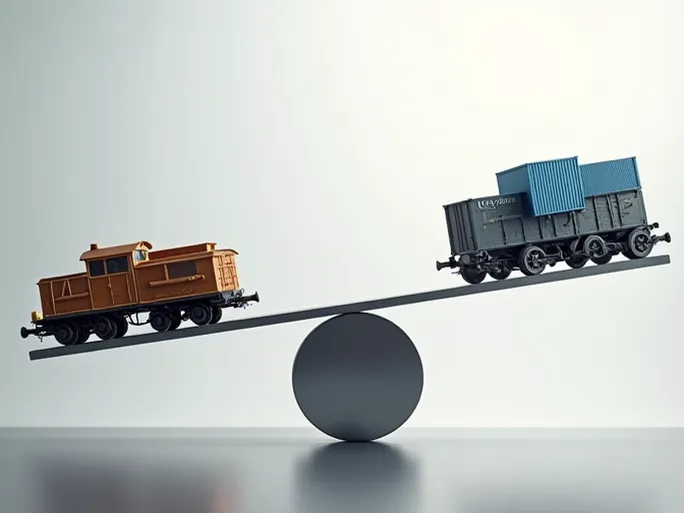

Recent data from the Association of American Railroads (AAR) paints a nuanced picture of the US rail freight market during the week ending January 21: carload volumes showed modest growth while intermodal traffic continued its decline. This divergence signals potential shifts in supply chain dynamics.

Carload Volumes: Drivers Behind the Modest Growth

The AAR reported 230,545 rail carloads during the observed week, marking a 3.3% year-over-year increase. While this represents positive momentum compared to the 212,962 carloads recorded in the week ending January 7, it falls slightly below the 244,171 carloads reported for January 14, indicating market volatility.

Five of the ten major commodity categories tracked by AAR demonstrated growth:

- Nonmetallic minerals surged by 5,895 carloads to 31,264, driven by ongoing infrastructure projects

- Coal increased by 2,454 carloads to 68,675, reflecting seasonal energy demand

- Motor vehicles & parts rose by 2,321 carloads to 13,166, signaling automotive sector recovery

However, declines emerged in other sectors:

- Chemicals dropped by 2,891 carloads to 31,038, potentially reflecting global economic pressures

- Grain decreased by 1,262 carloads to 22,015, possibly due to agricultural export challenges

- Forest products fell by 799 carloads to 9,065, potentially tied to cooling housing markets

Intermodal Decline: Underlying Causes

Intermodal units (containers and trailers) totaled 236,940 during the week, representing a 6.7% year-over-year decrease. Though higher than the 203,257 units recorded on January 7, the figure remained below January 14's 241,829 units, confirming a persistent downward trend.

Key factors contributing to this decline include:

- Improved port operations reducing reliance on rail alternatives

- Inventory adjustments among retailers and manufacturers

- Potential consumer spending slowdowns amid inflationary pressures

North American Overview: Modest Contraction

Expanding the analysis to include 12 major North American railroads (US, Canada, Mexico) reveals:

- 336,113 total carloads (up 6.8% year-over-year)

- 309,502 intermodal units (down 6.7%)

- Combined weekly volume of 645,615 units (down 0.1%)

Year-to-date figures through January 21 show 1,893,180 total units transported across North America, representing a 0.5% decrease compared to 2022.

Market Outlook: Balancing Risks and Opportunities

The rail freight sector faces competing pressures as 2023 progresses. While global economic uncertainty and inflationary trends may suppress demand, potential growth drivers include:

- Continued infrastructure investment

- Evolving energy market dynamics

- Automotive industry recovery

Rail operators are responding through operational improvements including:

- Enhanced train scheduling technologies

- Network optimization initiatives

- Specialized service expansions (e.g., refrigerated transport)

For supply chain professionals, these mixed signals underscore the importance of agile logistics planning to navigate an evolving transportation landscape.